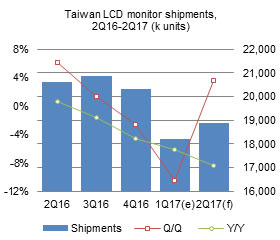

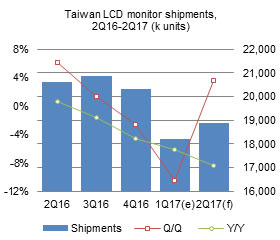

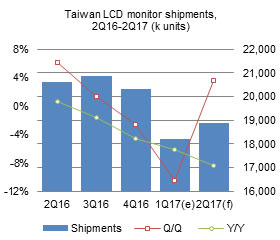

Taiwan's LCD monitor shipments slipped under the 20 million threshold in the first quarter of 2017, slipping 6.2% on year to reach only 18.21 million units, as demand for LCD monitors remained weak. LCD monitor demand is unlikely to see any major recovery and therefore, Taiwan's shipments are expected to continue suffering from an on-year decline of 8.4% in the second quarter.

Table of contents

1Q review and 2Q forecast

Introduction

Shipments

Chart 1: LCD monitor shipments, 1Q16-2Q17 (k units)

Chart 2: Taiwan's worldwide market share, 1Q16-2Q17 (k units)

Shipments breakdown

Production value and ASP

Chart 3: Taiwan LCD monitor production value, 4Q15-1Q17 (US$m)

Chart 4: Taiwan LCD monitor ASP, 4Q15-1Q17 (US$)

Makers

Chart 5: Shipments by makers, 1Q16-2Q17 (k units)

Chart 6: Top-4 makers' shipments by client, 1Q17 (k units)

Chart 7: Top-4 makers' shipment share by client, 1Q17

Chart 8: Top-4 makers' shipments by client, 4Q16 (k units)

Chart 9: Top-4 makers' shipment share by client, 4Q16

Chart 10: Major vendors' order distribution, 1Q17

Chart 11: Major vendors' order distribution, 4Q16

Business models: OBM, OEM/ODM

Chart 12: Shipments by business model, 4Q15-1Q17 (k units)

Screen sizes

Chart 13: Shipments by screen size, 1Q16-2Q17 (k units)

Chart 14: Shipment share by screen size, 1Q16-2Q17

Outlook for 2017

Chart 15: Taiwan and worldwide LCD monitor shipments, 2013-2017 (k units)

Chart 16: Shipments by makers, 2016-2017 (k units)

Taiwan's LCD monitor shipments slipped under the 20 million threshold in the first quarter of 2017, slipping 6.2% on year to reach only 18.21 million units, as demand for LCD monitors remained weak. LCD monitor demand is unlikely to see any major recovery and therefore, Taiwan's shipments are expected to continue suffering from an on-year decline of 8.4% in the second quarter.

Taiwan's LCD monitor shipments slipped under the 20 million threshold in the first quarter of 2017, slipping 6.2% on year to reach only 18.21 million units, as demand for LCD monitors remained weak. LCD monitor demand is unlikely to see any major recovery and therefore, Taiwan's shipments are expected to continue suffering from an on-year decline of 8.4% in the second quarter. Taiwan's LCD monitor shipments slipped under the 20 million threshold in the first quarter of 2017, slipping 6.2% on year to reach only 18.21 million units, as demand for LCD monitors remained weak. LCD monitor demand is unlikely to see any major recovery and therefore, Taiwan's shipments are expected to continue suffering from an on-year decline of 8.4% in the second quarter.

Taiwan's LCD monitor shipments slipped under the 20 million threshold in the first quarter of 2017, slipping 6.2% on year to reach only 18.21 million units, as demand for LCD monitors remained weak. LCD monitor demand is unlikely to see any major recovery and therefore, Taiwan's shipments are expected to continue suffering from an on-year decline of 8.4% in the second quarter.