As airlines aim for carbon neutrality by 2050, sustainable aviation fuel emerges as a critical—but expensive—solution.

In the race to decarbonize, the aviation industry faces a turbulent journey. With air travel accounting for 2.5% of global CO2 emissions and poised to climb higher, airlines are betting big on Sustainable Aviation Fuel (SAF).

The European Parliament has approved the ReFuelEU Aviation regulation, which will require fuel suppliers to blend increasing levels of sustainable aviation fuels. Starting in 2025, fuel uplift at EU airports must contain at least 2% SAF, rising to 6% by 2030 and 70% by 2050.

SAF, derived from biomass such as algae, crop residues, animal waste, and even household waste, has emerged as the industry's silver bullet. It is capable of reducing lifecycle CO2 emissions by 70-80% compared to traditional jet fuel.

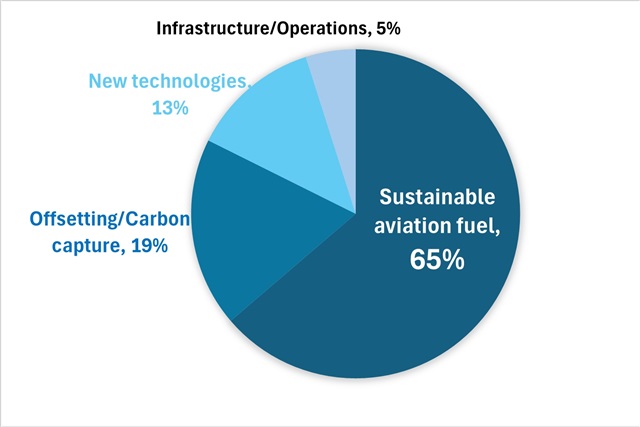

The International Air Transport Association (IATA) projects that SAF will account for 65% of aviation's carbon mitigation by 2050. However, the current global SAF usage stands at a mere 0.1% of total jet fuel consumption, highlighting the enormous gap between ambition and reality.

Net zero 2050 by combination of measures

Source: IATA

The price tag of sustainability is steep. With SAF costing 3-5 times more than conventional jet fuel, airlines face significant financial challenges. EVA Air, for instance, estimates an additional NT$2.5-3 billion (US$80-95 million) annual cost to use just 2% SAF in its operations.

On a global scale, PwC reports that the industry needs EUR1 trillion in capital expenditure for SAF refineries to meet 2050 targets. Production hurdles further complicate the picture.

While 2024 projected SAF production is expected to reach 1.9 billion liters, this represents only 0.53% of global aviation fuel needs. S&P Global estimates that 17.5 billion gallons of SAF will be required annually by 2050 to meet global targets. Adding to the challenge is the limited feedstock diversity, with 80% of near-term SAF expected to come from used cooking oils and animal fats.

To overcome these obstacles, IATA suggests diversifying feedstocks, co-processing renewable feedstocks in existing refineries, and providing incentives to shift renewable fuel production toward SAF. The US Grand Challenge, with its US$3 billion investment to accelerate SAF development, offers a model for government intervention. The industry is also seeking stable, long-term tax credits and policies to shift renewable fuel production towards aviation.

Airlines like EVA Air are already charting their course towards sustainability, actively participating in international and domestic greenhouse gas reduction programs such as CORSIA and the EU ETS. The carrier has set ambitious targets of 2% SAF use by 2025 and 10% by 2035.

EVA Air's strategy encompasses technology development, operational efficiency improvements, carbon offsets, and gradual SAF adoption. Moreover, the airline has launched "Green Travel" and "Green Transport" programs for corporate clients to complement their green manufacturing practices, reinforcing their commitment to sustainability.

A recent IATA survey revealed strong public support for SAF, with 86% of travelers agreeing that governments should incentivize airlines to use SAF. Similarly, 86% believe leading oil corporations should prioritize SAF production.

As airlines navigate this costly transition, the specter of "green inflation" looms. Higher ticket prices seem inevitable as carriers pass on increased fuel costs to consumers. Yet, industry optimists point to solar energy's dramatic cost reduction over the past decade as a potential model for SAF's future affordability.

The aviation industry's net-zero ambitions hinge on a delicate balance of technological innovation, policy support, and consumer willingness to pay for greener skies. As the 2050 deadline approaches, the pressure is on for SAF to take flight—both in volume and economic viability. The coming years will determine whether the industry can successfully navigate this challenging ascent towards a sustainable future.