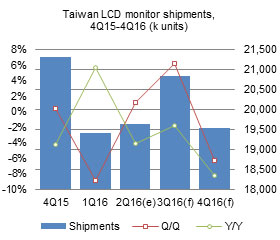

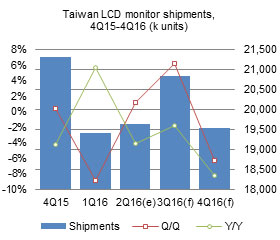

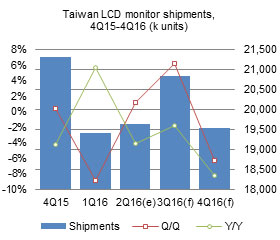

In terms on-year growth, the rebound that Taiwan's LCD monitor makers saw in their shipments in the first quarter of 2016 proved to be just a short break in a decline trend that continued in the second quarter. Such a trend is expected to continue through the end of the year.

Table of contents

Introduction

Chart 1: LCD monitor shipments, 2Q15-4Q16 (k units)

Chart 2: Taiwan's worldwide market share, 2Q15-4Q16 (k units)

Shipments breakdown

Production value and ASP

Chart 3: Taiwan LCD monitor production value, 1Q15-2Q16 (US$m)

Chart 4: Taiwan LCD monitor ASP, 1Q15-2Q16 (US$)

Makers

Chart 5: Shipments by top-5 makers, 2Q15-4Q16 (k units)

Table 1: Maker-vendor relationships, 2Q16 (k units)

Table 2: Maker-vendor relationships, 1Q16 (k units)

Business models: OBM, OEM/ODM

Chart 6: Shipments by business model, 1Q15-2Q16 (k units)

Screen sizes

Chart 7: Shipments by screen size, 1Q15-2Q16 (k units)

Chart 8: Shipment share by screen size, 1Q15-2Q16

Annual shipments

Chart 9: Taiwan and worldwide LCD monitor shipments, 2012-2016 (k units)

Chart 10: Shipments by top makers, 2015-2016 (k units)

In terms on-year growth, the rebound that Taiwan's LCD monitor makers saw in their shipments in the first quarter of 2016 proved to be just a short break in a decline trend that continued in the second quarter. Such a trend is expected to continue through the end of the year.

In terms on-year growth, the rebound that Taiwan's LCD monitor makers saw in their shipments in the first quarter of 2016 proved to be just a short break in a decline trend that continued in the second quarter. Such a trend is expected to continue through the end of the year. In terms on-year growth, the rebound that Taiwan's LCD monitor makers saw in their shipments in the first quarter of 2016 proved to be just a short break in a decline trend that continued in the second quarter. Such a trend is expected to continue through the end of the year.

In terms on-year growth, the rebound that Taiwan's LCD monitor makers saw in their shipments in the first quarter of 2016 proved to be just a short break in a decline trend that continued in the second quarter. Such a trend is expected to continue through the end of the year.