Japanese electronics manufacturer MinebeaMitsumi has decided to extend its tender offer for temperature sensor producer Shibaura Electronic until July 1, postponing the initial deadline of June 19. The company confirmed that its offer price would remain steady at JPY5,500 (approx. US$37.90) per share. This move comes as rival bidder Yageo, based in Taiwan, continues to face investigation by Japan's foreign exchange regulatory authorities.

In comments reported by Nikkei, MinebeaMitsumi CEO Yoshihisa Kainuma said the decision to extend the offer was driven by regulatory compliance under Japan's Financial Instruments and Exchange Act. The law requires that if an amended securities registration statement is submitted during a tender offer period, the offer must remain open for at least 10 additional trading days. MinebeaMitsumi plans to file its revised statement on June 26.

Yageo's bid under national security review

MinebeaMitsumi's bid remains below the JPY6,200 (US$42.72) per share offer submitted by Yageo, which launched an unsolicited tender in May without Shibaura's prior consent. The Taiwanese firm refiled its foreign direct investment documentation under Japan's Foreign Exchange and Foreign Trade Act on June 2 and says discussions with the Ministry of Economy, Trade and Industry are progressing steadily.

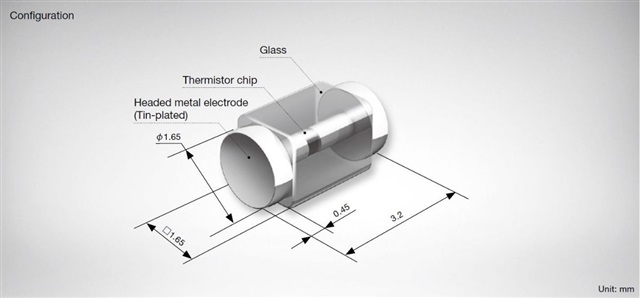

Kainuma emphasized that MinebeaMitsumi has no intention of revising its offer until Japan concludes its national security review of Yageo's bid. Shibaura's sensor technologies, including NTC thermistors, have potential defense and aerospace applications, making them subject to stringent regulatory vetting. He noted that although a more substantial offer might be contemplated in the future, such a step is improbable in the immediate timeframe.

Shibaura is a manufacturer of NTC thermistors and temperature sensors. Credit: Shibaura

Contention over Shibaura's strategic acquisition

MinebeaMitsumi has repeatedly criticized Yageo for launching a takeover without first clearing regulatory hurdles. The Japanese company has positioned itself as a "white knight," arguing that Shibaura's sensitive technologies should remain under domestic ownership.

Yageo, meanwhile, has urged Shibaura to facilitate fair, in-person negotiations with both parties. A meeting between Shibaura and Yageo is expected to take place on June 18, during which business synergies between the two companies will be examined.

Article edited by Jack Wu