The tablet craze sparked by Apple has not only given fresh impetus to the convergence of 3C markets (computers, communications and consumer electronics), but has also engulfed the entire ICT industry with its radically different business models, ushering in a new era in the mobile computing market.

Tablet shipments were up more than 420% from one year earlier in the first half of 2010 and the market will continue with its positive momentum in the second half of the year, with shipments expected to be up more than 150% from one earlier. While Apple remains the dominant player with its iPad line, other major vendors have looking to gain traction in this booming market.

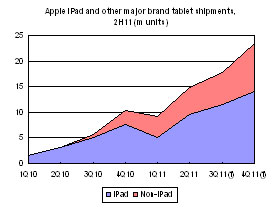

While Apple remains the dominant force in the tablet market, major 3C brands are making the most of their own strengths and are projected to ship more than 20 million tablets in the second half of 2011.

Android has developed even more rapidly in the tablet sector than in smartphones, with a penetration rate of more than 30%. In terms of core application processors, Nvidia's Tegra series has been widely supported by brands other than Apple. However, shipment figures from Digitimes Research suggest that Texas Instruments (TI) is likely to be the firm to beat out in this area.

The contribution of Taiwan's electronics industry to the meteoric rise of the tablet industry should not be overlooked. In addition to the overwhelming advantage enjoyed by Taiwan's OEM device/product makers, Taiwan's touchscreen panel industry has also played a critical role in the branded tablet market, with Taiwan-based firms being the partner of choice for brands wishing to move into the tablet market quickly. This report takes a detailed look at the role of the Taiwan electronics industry in the development of the tablet supply chain.

Chart 1: Apple iPad and other major brand tablet shipments, 1H11 (m units)

Chart 2: Apple iPad and other major brand tablet shipments, 2H11 (m units)

Chart 13: Shipment forecast by tablet screen size, 1Q11-4Q11

Chart 15: Shipment proportion by tablet operating system, 2011

Chart 16: Growth of iOS and Android (k devices activated per day)

Chart 17: 2011 price points for tablets, based on application processor used

Chart 18: Tablet shipment share by application processor, 2011

Chart 19: Tablet shipment share by touch panel technology, 2011

Chart 20: Virtually all mainstream tablets in 2011 use ARM architecture

Chart 23: Qualcomm and Marvell have adopted a fully-customized route for their cores

Chart 25: GPUs have already become indispensible components for mobile devices

Chart 26: The ARM-led Linaro organization is aimed at resolving compatibility problems

Chart 27: MIPS showcased several US$100 tablet and smartphone products at Computex 2011

Chart 28: Intel displayed several tablets at Computex, but no first-tier vendor support

Chart 29: Intel is aggressive cutting into mobile application industry via MeeGo and Android

Whether Atom’s revamped structure in 2013 will turn the course for Intel remains to be seen

Chart 30: Medfield has made progress, but still lacks in competitiveness against ARM

Chart 31: Intel will not have a revolutionary advance until 2013

Facing ARM structure’s challenge, x86 camp need to be more aggressive

Chart 32: AMD roadmap for APU structures will completely merge GPU and CPU together by 2014

Chart 33: Forecast of Taiwan’s share in global branded tablet shipments, 2011

Chart 34: Major Taiwan makers’ tablet shipments, 2011 (m units)

Chart 35: Major maker’ share of Taiwan tablet shipments, 2011

Chart 38: Proportion of total chip cost for mainstream Android-based tablets, by application

Chart 39: Memory & Storage chip vendors in the tablet market

Chart 40: Wireless communication chip vendors in the tablet market

Chart 41: Computing & Processing chip vendors in the tablet market

Chart 42: Multimedia & Interface chip vendors in the tablet market

Chart 43: Taiwan chip players opportunities in the tablet market

Chart 44: Taiwan TFT LCD suppliers’ market share of tablet-use panels, 2011

Chart 45: Tablet-use touch panel module market share, by supplier, 2011

Chart 46: AUO and Cando capacity for tablet-related displays

Chart 47: AUO, Cando, TPK and related clients’ tablet display supply chain

Chart 48: Current investment status of Foxconn and affiliates in tablet related industries

Chart 49: CPT and Compal form strategic alliance to invest in tablet-related industries

Chart 51: HannStar and HannsTouch investment in tablet-related industries

J-Touch and Young Fast: Thin-flim-type projected capacitive touch