2012 is the most important year in the history of the evolution of the Long Term Evolution (LTE) standard. According to the most recent figures from GSA (Global mobile Supplier Association), 96 commercial LTE networks were already in operation across 46 countries as of September 2012, including 11 commerical TDD-LTE networks. Major global players have already announced wide-ranging support for LTE technology and development, with the result that LTE is already becoming the mainstream global technology for 4G networks. Examples include carriers such as Verizon, AT&T and NTT DoCoMo; brand device and equipment makers such as Samsung and Ericsson; and chip suppliers such as Qualcomm.

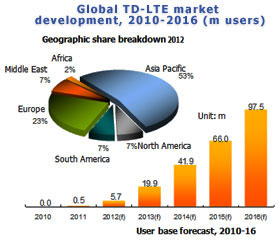

However, international differences in plannings and frequency allocation timetables have resulted in different frequency bands being used in different countries. The China-led TD-LTE standard's greater efficiency in terms of frequency spectrum usage has attracted the attention of carriers in a number of other countries. For example, Softbank, Japan's number three carrier, announced that it would offer commercial TD-LTE services from the first half of 2012, and has already garned nearly 200,000 users in the space of five months. China Mobile has expanded trial networks into a total of 13 cities in 2012, covering a population of around 100 million. As WiMAX users switch over and LTE gains momentum globally, Digitimes Research projects that the global number of TD-LTE users will reach 97.5 million by 2016, accounting for 23% of all LTE users.

TD-LTE equipment faces the same challenge as LTE equipment - namely that carriers are starting to switch to using Wi-Fi offload solutions to carry much of the burden of data service traffic. Wi-Fi equipment is easy to deploy, physically smaller and costs little, helping carriers to reduce data service costs. This is in turn forcing TD-LTE/LTE equipment makers to create smaller, cheaper products that will encourage carriers to continue using LTE solutions, rather than switching to Wi-Fi.

As increasing numbers of new, China-based players enter the market, and Wi-Fi threatens to replace LTE for some data services, Digitimes Research projects that competition in the TD-LTE equipment market will remain extremely intense in the short term at least. Over the medium term, once some equipment makers drop out of the market, or TD-LTE equipment becomes small enough and cheap enough to compete more effectively, the level of competition in the market is likely to ease off somewhat.

Chart 3: Use of radio-frequency spectrum in different geographic regions

Apple iPhone 5 with LTE capability affecting spectrum planning

Chart 4: Available frequency bands for LTE version of iPhone 5, by geographic region

Chart 5: LTE version of iPhone 5; available mobile operatorsby region

Table 1: Japan mobile carriers development of next-generation technologies, 2012

Chart 6: Japan AXGP TD-LTE subscribers and use of devices, 2012

Development of Japan 4G mobile technology and SoftBank network

Chart 7: Major Japan mobile operators: Frequency bands and spectrum allocations

Chart 11: Mobile voice/talk time in China, mobile data traffic through China Mobile, 2007-2012

Chart 13: Usage of Wi-Fi capable handsets in China and other major countries, 2011

Technical and environmental testing (September 2009-June 2010)

Chart 15: China Mobile plans for converged 2G/3G/4G/WLAN network

Chart 17: Global TD-LTE market development, 2010-2016 (m users)

Chart 18: Major trends in mobile telecoms technology standards

Chart 19: Distribution of LTE patents between major manufacturers

Chart 20: Distribution of TD-LTE patents between major manufacturers

Firms that attach a high degree of importance to the China market

Chart 23: Multi-mode TD-LTE chips are projected to be more marketable in long term

Competition based on product differentiation is still possible

Chart 25: Carrier equipment manufacturers' expansion into different technologies