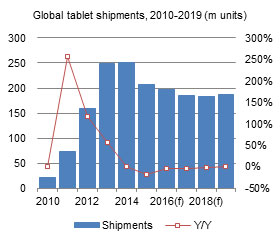

In 2016, global tablet shipments will drop 4.8%, compared to a decline of 17.9% in 2015. With the exception of Microsoft and Huawei, most brands will see flat growth or a small decline in shipments. Some other key trends that Digitimes Research expects to see in 2016 include a continued drop in demand for 7-inch consumer price-friendly Wi-Fi tablets or tablets with phone features; increased popularity of Microsoft's Surface series and Windows 10; and slight on-year growth for Apple.

Chart 1: Global mobile computing shipments, 2008-2016 (m units)

Chart 3: Global brand and white-box tablet shipments, 2013-2016 (m units)

Chart 4: Global tablet shipments by brand, 2014-2016 (m units)

Chart 5: Global brand tablet shipments by size, 2015-2016 (m units)

Chart 6: Global brand tablet shipment share by size, 2015-2016 (m units)

Chart 7: Tablet shipments and shipment share of Taiwan-based firms, 2011-2016 (m units)

Chart 8: Taiwan-based tablet shipments by maker, 2015-2016 (m units)

Chart 9: Taiwan-based tablet shipment share by maker, 2015-2016

Chart 10: Global tablet shipments by operation system, 2015-2016 (m units)

Chart 11: Global tablet shipment share by operation system, 2015-2016

Chart 13: Microsoft Surface product shipments and share, 2015-2016

Chart 14: Windows tablet shipments and shipment share by types, 2015-2016 (m units)

Chart 15: Tablet shipments from Google platforms, 2015-2016 (m units)