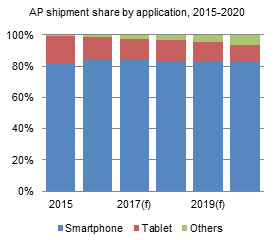

Digitimes Research expects global application processor (AP) shipments to increase more than 8% in 2017 and surpass the 1.9 billion mark, with smartphones remaining the main application. After slumping in 2015, Qualcomm returned to form in 2016 and will continue leading the market in 2017, as other players continue playing catch up and scramble for funds to invest in more diverse applications such as IoT and other smart end-device applications.

Chart 6: Shipments by manufacturing process, 2015-2020 (m units)

Chart 8: Shipments by baseband technology, 2015-2020 (m units)

Chart 11: Qualcomm shipments by application, 2015-2020 (m units)

Chart 13: Qualcomm shipment share by product series, 2015-2017

Chart 15: MediaTek shipments by application, 2015-2020 (m units)

Chart 17: MediaTek shipment share by product series, 2015-2017

Chart 19: Apple shipments by application, 2015-2020 (m units)

Chart 22: Spreadtrum shipments by application, 2015-2020 (m units)

Chart 23: Spreadtrum shipment share by application, 2015-2020

Chart 26: Samsung shipments by application, 2015-2020 (m units)

Chart 28: Samsung shipment share by product series, 2015-2017

Chart 29: Embedded GPU shipments by vendor, 2015-2017 (m units)