Arm filed for a long-awaited IPO on August 21, which may be the largest IPO in years. Technology companies that use Arm-based chips are expected to invest.

Arm, the chip designer owned by SoftBank Group, submitted documents to the US SEC for an IPO on Nasdaq. Bloomberg reported that Arm's roadshow is expected to begin in the first week of September and price the IPO in the following week. According to Bloomberg, Apple, Samsung, Nvidia, and Intel may invest in Arm as long-term investors.

SoftBank Group, the owner of Arm, reportedly aims for a US$60–70 billion valuation. The company is not required to disclose details regarding the offering's pricing or the number of shares to be made available in its filing for now.

In a regulatory filing to the US SEC, Arm said its energy-efficient CPUs have enabled advanced computing in more than 99% of the world's smartphones and over 250 billion chips, powering everything from the tiniest of sensors to the most powerful supercomputers. Furthermore, Arm said more than 260 companies, including Amazon, Alphabet, AMD, and Intel, had shipped Arm-based chips in the fiscal 2023 (April 2022 to March 2023).

Arm said its risks include a dependence on the cycles in the semiconductor and electronics industry, intense competition, and a potential market loss to competitors. Arm's operational activities, especially the revenues generated from licensing and royalties, can vary significantly between periods and may be unpredictable.

Arm mentioned its revenue sources relied on a limited number of customers, and the concentration of revenue from China makes the chip IP provider particularly susceptible to economic and political risks, which the US-China and UK-China tensions can exacerbate.

In recent years, Arm has been trying to diversify beyond the smartphone industry and into high-performance applications. Arm said in the filing that Arm CPUs have already run AI and ML workloads in billions of devices and are working with Alphabet, General Motors, Mercedes-Benz, Meta, and Nvidia to deploy Arm technology to run AI workloads.

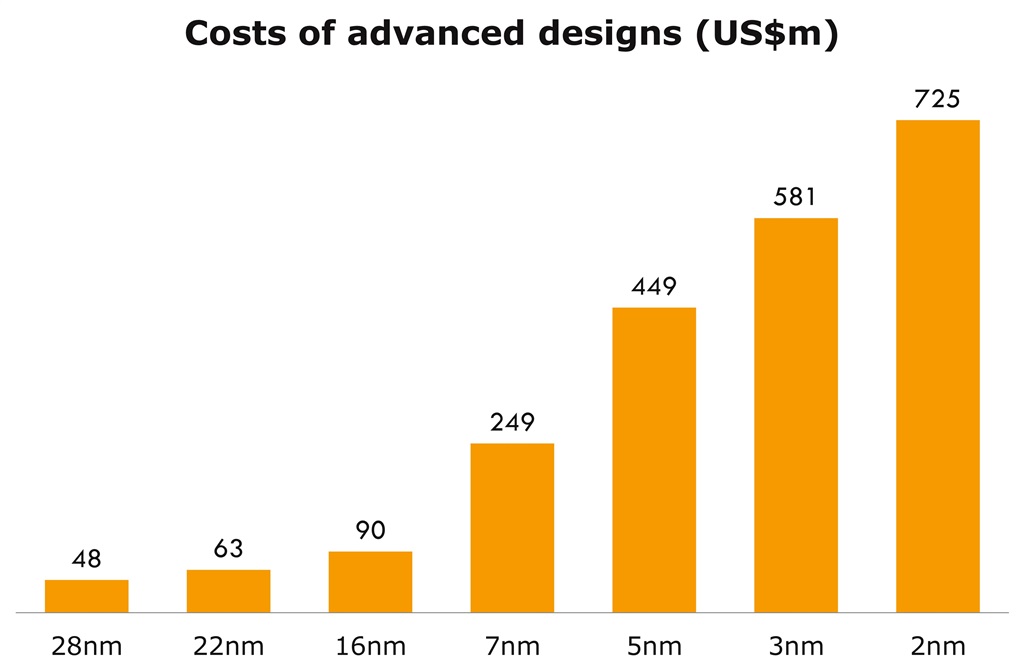

Arm believes it can benefit from advanced chips. Arm quoted International Business Strategy saying that IC design costs were US$249 million for a 7nm chip and US$725 million for a 2nm chip, and the software development, verification, and IP qualification is 71% of the overall cost while designing a 2nm chip.

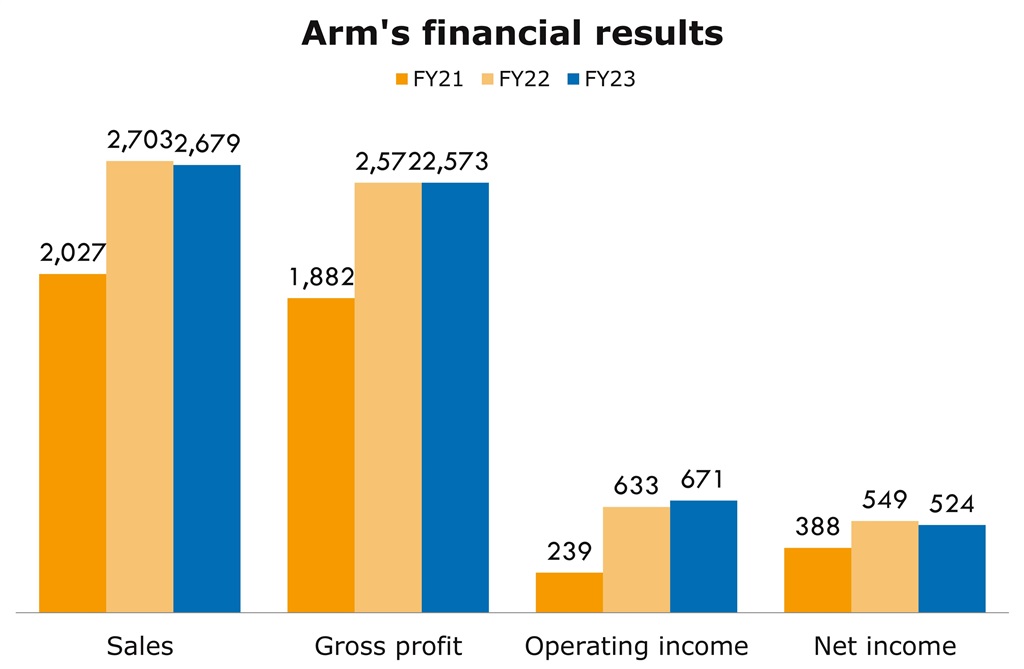

Nvidia proposed to acquire Arm, but the proposal was blocked by the US FTC. According to Arm's regulatory filing, the company saw revenue fall in fiscal 2023 amid the weak global demand for chips.

Source: Arm, August 2023

Source: Arm, August 2023