The launch of Windows 8 is a more significant event than the release of Windows 7, both for Microsoft and for the industry as a whole. It represents an extension of the PC industry's applications and ecosystem and an attempt to secure core value in the mobile computing market. Analysis by Digitimes Research shows that Windows 8 is not simply a necessary pushback by Microsoft against the challenge of the Android and iOS platforms; even more importantly, it marks the opening salvo in the battle for users between PCs and mobile devices such as smartphones and tablets.

Digitimes Research projects Windows Phone 8 (WP8) smartphones launched between the second half of 2012 and early 2013 will focus on the high-end market, with WP7 models targeted at the lower end of the market; a simplified version of WP7 is also likely to ship on handsets with an unsubsidized price of less than US$100.

Windows 8 will have two major impacts on the PC and tablet markets. Firstly, it will stimulate growth in touchscreen devices. Projective capacitive touch panels are likely to become the mainstream touch technology on the basis of current trends, and their use with spread from mobile devices into PC products. However, as Windows 8 systems are not likely to be launched until the end of 2012, the penetration rate of projective capacitive panels in PC products for the whole of 2012 will be only around 1%.

Second, Windows 8 will expedite the uptake of ultra-thin systems like ultrabooks and tablets, and will therefore increase the penetration rate of SSDs in Windows systems. SSD-equipped notebooks have already seen major breakthroughs in sales during 2012, with whole-year shipments surpassing 10 million units. Windows 8 tablets that use Intel CPUs will also use SSDs as their main storage devices, and are projected to ship around one million units in 2012.

Windows 8 - Microsoft focus shifts from PC to mobile devices

Microsoft to use control of platform to promote apps and services

Chart 1: WP Marketplace reaches 100,000 apps as MS strives to develop ecosystem

Chart 2: Microsoft eyeing closed ecosystem, potentially excluding players in related industries

Chart 3: Microsoft's long-term strategy is to develop digital content businesses

Chart 5: Microsoft works to further integrate digital content platforms into its OS lines

Chart 6: Microsoft gradually integrating its PC and mobile software platforms

Shared kernel of WP8 and Windows 8 to aid development of PC platform

Chart 7: Microsoft PC and mobile device software platforms gradually being unified

Chart 9: Market share by shipments for three major smartphone platforms

Chart 10: Market share by shipments for three major smartphone platforms, 2009-2012

Microsoft's primary goal with the Surface is to increase number of Windows RT devices

Microsoft needs to launch demonstration models for Windows tablets

Chart 12: Microsoft using Surface as blueprint for development of Windows tablets

Surface form factor will limit the scope for development for competing devices

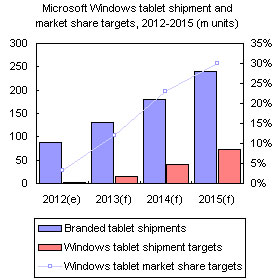

Chart 13: Microsoft Windows tablet shipment and market share targets, 2012-2015 (m units)

Microsoft prepared to expand its Surface business, but has yet to take action

Chart 14: Surface shipments are likely to reach 1.5m units in 2H12 (k units)

Chart 15: Nook perhaps to be discontinued given Microsoft's overall strategy

Probability of Microsoft discontinuing Nook device line is high

Chart 16: The probability of Microsoft discontinuing the Nook device product line is high

Chart 18: Global branded Windows tablet shipments by brand, 2H12

Chart 19: Global branded Windows tablet shipments by OS variant, 2H12

Chart 20: Global branded Windows tablet shipment share by processor, 2H12

Chart 21: Windows 8 dual interface modes may cause confusion amongst developers

Chart 23: Many touch technologies used with Windows 7 will not be usable with Windows 8

Chart 24: Infrared is costly but capable of 10-point multitouch, although major appeal is durability

Chart 27: Despite Wintel confidence in touchscreen environment, pricing remains issue

Chart 28: Taiwan-based manufacturers' shipments for PC touch panels, 1Q12-4Q12

Chart 29: Touch panel share of monitor and notebook markets, 2H12

Chart 30: Shipments of ultrabooks and SSD-based MacBooks, 4Q11-4Q12 (k units)

Projected impact of Windows 8 on desktop and notebook demand

Chart 32: Shipments and penetration rates for new types of notebooks (k units)

x86 to dominate in business-oriented and high-performance tablets

Chart 33: x86 will continue to be suited to a wider range of applications than ARM

Chart 34: Power consumption and potential Windows 8 positioning for different architectures

Table 2: Main solution options for Windows 8 tablets in 2013

Chart 36: Windows 8/RT system core shipment share forecasts for 2012

ARM architecture lacks clear cost advantage on Windows platform

Intel still needs to bolster its driver support capabilities