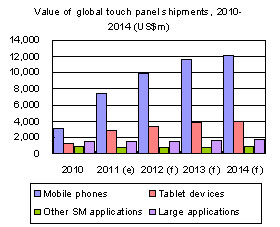

The touch panel sector was one of the few bright spots in the global tech industry in 2011, with production value growing 88% on year to reach US$12.56 billion. Shipments are expected to increase 25% in 2012 and though growth will slow through 2014, the strong market is driving competition among players in Korea, Japan and Greater China.

This Digitimes Special Report examines the role of the different regions and the technologies and manufacturing methods being employed and developed in order to gain a competitive edge in the market.

Outlook and analysis of global touch panel market (2010-2014)

Chart 1: Value of global touch panel shipments, 2010-2014 (US$m)

Chart 2: Global shipments of touch panels for use in tablets, 2010-2012 (k units)

Chart 3: Global touch panel shipment volumes, 2010-2014 (k units)

Chart 4: Value of global touch panel shipments, 2010-2014 (US$m)

Chart 5: Global shipments of touch panels for use in mobile phones, 2010-2014 (m units)

Embedded touch panels as competitive advantage for Japan and South Korea makers

Chart 6: Global shipment volumes of embedded AMOLED touch panels, 2010-2014 (k units)

Touch panel makers in the Greater China region introduce OGS and roll-to-roll processes

China-based firms likely to increase penetration rates through low prices

Chart 8: Mobile phone touch panel shipment share by manufacturer region, 2011-2012,

Taiwan-based manufacturers remain the principle suppliers for tablet touch panels

Chart 10: Tablet touch panel shipments by manufacturing region, 2011-2012

Significant technical hurdles must be overcome for large touch panels suitable for PCs

Chart 11: Pros and cons of the launch of Windows 8 for the touch panel industry

Taiwan-based touch panel makers - trends and supply chain analysis

Table 1: Supply chain for projective-capacitive touch panels

Trends and supply chain analysis for projective-capacitive touch panel manufacturers

Chart 12: Mobile phone projective-capacitive touch panel shipments and share thereof, 2011-2012

TPK to maintain competitiveness through acquisitions and product line expansion

Chart 13: TPK's three main strategies to cope with the changing market

Chart 14: Winketk transition from one conventional to three new technologies

Other manufacturers remain focused on touch sensor, with OGS the hope for the future

Chart 15: Business development map for Taiwan's major glass touch panel manufacturers

Trends and supply chain analysis for thin-film projective-capacitive touch panel manufacturers

Table 2: Recent developments for Taiwan's three main thin-film touch panel manufacturers

Table 3: Recent client base expansion by Taiwan's three main thin-film touch panel makers

Table 4: Recent developments in the touch panel businesses of Taiwan's TFT LCD manufacturers

Table 5: Capacity expansion efforts at Taiwan's major touch panel manufacturers (m units)

Trends and supply chain analysis for China-based touch panel manufacturers

Chart 16: Mobile phone touch panel shipment share by manufacturer region, 2011-2012

Chart 17: Three main trends in the China touch panel industry

Chart 19: Mobile phone touch panel shipments to Samsung by supplier region, 2011-2012

Chart 20: Global smartphone shipment share by vendor, 2011-2012

China-based manufacturers to focus mainly on thin-film touch panels

Table 8: Distribution of factories for China's major touch panel makers, 2011-2012

Trends and supply chain analysis for projective-capacitive panel makers

EELY sticks to its thin-film printing process and catches eye of Samsung

Mutto possesses yellow-light photolithography process equipment for thin-film touch panels

Recent developments for China's other major touch panel makers

Table 13: Recent devlopments for other China-based touch panel makers

Tianma leads China's TFT LCD manufacturers in terms of touch panel business development

Strengths and weaknesses of the touch panel industries in Taiwan and China

New touch panel technologies and involvement by manufacturers in the Greater China region

Chart 21: Past and future efforts to simplify touch panel structures

Comparison of thin-film and glass-type projective capacitive touch panel technologies and pricing

Chart 22: Prices of GFF and GG projective-capacitive touch modules (US$)

Outlook for new projective-capacitive touch panel technologies

Chart 23: Comparing the structure of OGS and embedded touch panels

G1F and OGS share process technologies to manufacture touch sensors directly on cover glass

Chart 24: The two main methods of putting touch sensors on to cover glass

Table 15: New projective-capacitive touch panel technologies and global manufacturers' involvement