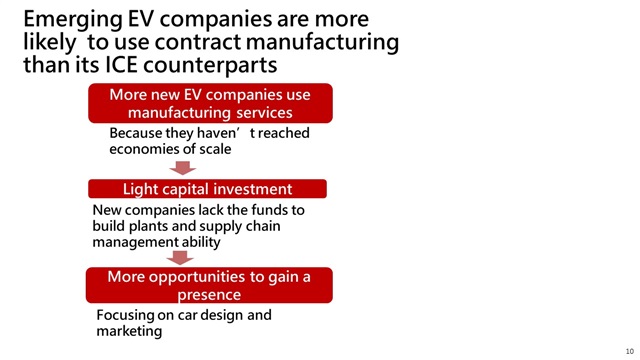

Automotive electrification facilitates the growth of new EV companies. According to DIGITIMES Research, emerging businesses tend to rely on contract manufacturers for car-making, so they can focus on building brands and marketing.

Jessie Lin, an analyst with DIGITIMES Research, said EVs generally require 37% fewer components than gasoline cars. The less complicated supply chain enables EV companies to use contract manufacturing common in the ICT industry.

Lin said partnering with other experienced carmakers can help a new EV company enter the market without heavy capital investment at the beginning. It commonly takes US$1 billion to build a production capacity for 100,000 EVs.

Source: EV-volumes, DIGITIMES Research

Building its own vehicle plant will become a severe financial burden if an EV company has yet to reach the economies of scale. According to Lin, a general indicator for achieving economies of scale is selling 10,000 cars per month. Different businesses might need to meet individual requirements to reach the accomplishment.

She added that an EV is composed of about 19,000 parts, which challenges a new company's capability of managing the supply chain. By using contract manufacturers, emerging companies can focus on building their reputation and gaining market presence without worrying about supply chain management.

Source: EV-volumes, DIGITIMES Research

EV contract manufacturing is common in China. Nio, one of the leading new EV companies, has partnered with JAC Motors since 2016. JAC is an automaker with a history of close to 60 years. The pair co-owned a factory in Hefei, China. Nio later built a second plant in the region by itself.

At the end of 2022, JAC announced that it plans to purchase Nio's asset for equipment installation at CNY1.7 billion (US$251.8 million). Industry sources said the transaction almost means Nio will sell the self-built plant to JAC.

Electronics Manufacturing Services leader Foxconn also targets the EV contract manufacturing market. It aims to mass-produce cars for companies like the US-based Fisker in 2024. Moreover, Canoo, another US-based EV startup, plans to use a third-party service for the initial production of the vans it will supply to Walmart.

While manufacturing services can help a new business break barriers to entry, many companies construct their own plants later. Lin said modern automotive manufacturing usually integrates hardware and software. An emerging EV business may want to produce cars by itself to protect proprietary techniques and accelerate new feature realization when accumulating enough funds for a production base.

Lin also said as automotive electronic/electrical architecture (EEA) becomes modularized, EV assembly will grow to be more like assembling a smartphone. Therefore, similar contract service models for the ICT industry can apply to the EV segment.

She added that current EEA tends to combine different functions to form several systems and modules in a car. With this trend, automakers can build a vehicle more efficiently.

About the analyst

Jessie Lin holds a master's degree in business administration from National Taiwan University of Science and Technology. She is the chief EV analyst at DIGITIMES Research. Her research covers CarTech, LED and flat panel displays.