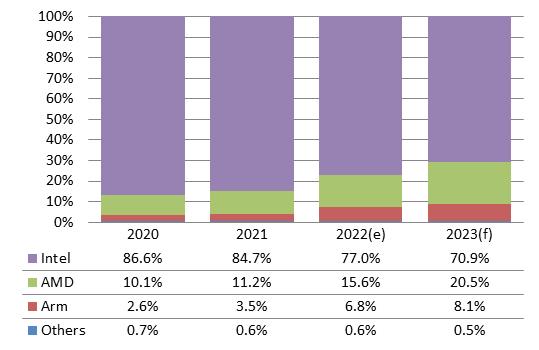

AMD and Arm have been gaining up on Intel in the server CPU market in the past few years, and the margins of the share that AMD had won over were especially large in 2022 as datacenter operators and server brands began finding that solutions from the number-2 maker growing superior to those of the long-time leader, according to Frank Kung, DIGITIMES Research analyst focusing primarily on the server industry, who anticipates that AMD's share will well stand above 20% in 2023, while Arm will get 8%.

Prices are one of the three major drivers that resulted in datacenter operators and server brands switching to AMD. Comparing server CPUs from AMD and Intel with similar numbers of cores, clockspeed, and hardware specifications, the price tags of most of the former's products are at least 30% cheaper than the latter's, and the differences could go as high as over 40%, Kung said.

Such a gap makes a key difference to server companies as they usually procure their CPUs in large volumes and picking AMD's solutions would make a major reduction in their costs. Since Intel's and AMD's processors are both based on the x86 architecture, compatibility is not an issue that server companies need to worry about, Kung noted.

AMD CPUs' high number of cores also makes them perfect for the server environment as the higher the number of cores a CPU has, the more servicing capability it can offer. AMD's 96-core Genoa-architected EPYC processor was launched in the fourth quarter of 2022 with a 128-core CPU set to debut in the first half of 2023, while Intel's best offering in terms of the core number still stays at 60 at the moment.

Support from TSMC is the second driver. AMD's server CPUs are all made via TSMC's latest manufacturing process, allowing them to feature top-notch performances, noted Kung, adding that thanks to TSMC's advanced technologies and high yield rate, AMD has not had a problem with missing its product launch schedule. However, such is not the case with Intel.

The third driver is the fact that Intel is manufacturing all its top-tier CPUs in house. Information from Intel's upstream suppliers shows that Intel's in-house manufacturing technologies have been rather unstable during the past several years, while server brands and datacenter operators have often seen Intel delaying the volume production schedule of its new server platform.

Read more: Meet the Analysts articles

Among datacenter operators, Microsoft and Google are the keenest in procuring servers powered by AMD's solutions. Currently, over 30% of server orders placed by the two cloud service providers are AMD-based models, while within server brands, HP Enterprise (HPE) is keener on AMD-powered servers.

Arm-based processors' penetration in the server market was a bit slower compared to AMD-based ones in 2022 in terms of market share increase, and the growth will decelerate even more in 2023, said Kung. However, in the long term, Arm-based processors will still have the potential for major growth.

Although Arm-based CPUs can achieve a neck-to-neck computing performance compared to x86-based ones from AMD and Intel while consuming much less power, compatibility is currently their biggest weakness.

Since most server programs are designed based on the x86 architecture, the problem is unlikely to fix until more Arm-based servers start to show up, attracting more middleware developers to join the market and write solutions to translate x86 codes for Arm systems.

However, datacenter operators and server brands are still aggressive about Arm processors' development in the server market. Amazon and Alibaba have already started working on Arm-based products before 2022, Microsoft and Google also began projects with Arm products in 2022, and HPE is expanding its adoption of Arm-based servers. Nvidia is now pushing its GPUs to support Arm architecture and Ampere is developing Arm-based chips. In the upcoming years, the opportunity from ESG is expected to take off for Arm CPUs as demand from large-scale datacenter and edge computing servers will surge, Kung added.

Chart 1: Server shipment share by CPU, 2020-2023

Source: DIGITIMES Research, February 2023

Table 1: Server CPU roadmaps by supplier, 2021-2024 | ||||

Supplier | 2021 | 2022(f) | 2023(f) | 2024(f) |

Intel | Whitley: supports PCIe 4.0; 10+nm node | Sapphire Rapids: supports PCIe 5.0; Intel 7 node | Emerald Rapids: Intel 7 node | Granite Rapids: Intel 3 node |

AMD | Milan: supports PCIe 4.0; 7nm node | Milan-X Genoa: supports PCIe 5.0, 5nm node | Bergamo, Genoa-X and Siena: 5nm node | Turin: 3nm node |

Arm | Neoverse N1 | V2 | New N series | |

Ampere | Altra Max: 7nm node | AmpereOne-1: supports PCIe 5.0; 5nm node | AmpereOne-2 | AmpereOne-3: 3nm node |

Nvidia | Grace: 5nm node | |||

Source: DIGITIMES Research, February 2023

About the Analyst

Frank Kung has an MSc degree in Technology Innovation Management and a bachelor's degree in electrical engineering. He has accumulated more than 10 years of research and project management experience at an industrial PC firm, the Institute of the Information Industry, etc. Currently, his main research areas include the server industry and application market observation, such as HPC, AI, data center, and edge computing development trends.