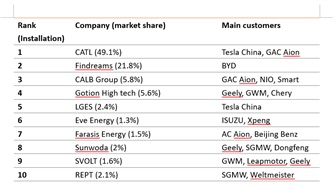

The China Passenger Car Association (CPCA) recently released its February 2023 insights report on the three electrical systems (motor, battery, control) of China's new energy vehicles (NEVs). The report pointed out that in February, the NEV power battery installation volume reached 18.4 GWh, a 66% growth. Among them, battery maker CATL continues to lead the market with a market share of 49%. The BYD-invested Findreams Battery came in second, with a 22% market share.

CATL's most important customers are, in order, Tesla China, GAC's Aion, Li Auto, Geely, and Nio. Findreams' key customer is BYD, which accounts for more than 90% of the installation volume. The report also pointed out that because of the pulling force from Tesla China, the installation volume of LG Energy Solutions (LGES) has also increased. Another fast-growing battery maker is the CALB Group, which reached third with a 6% market share. Its main client is GAC's Aion.

Top 10 battery makers in China and their main customers (Feb. 2023)

Note: Only customers with a higher than 10% share are listed.

Source: CPCA, compiled by DIGITIMES Asia, March 2023

In terms of batteries, from January-February 2023, the use of lithium iron phosphate batteries in regular passenger cars has increased by 65% and is expected to continue to grow. In terms of battery shapes, square, cylindrical, and soft-pack battery cores each comprise, respectively, 92%, 5%, and 3% of the market.

From January-February 2023, China's NEV production capacity reached 970,000 units, a 16% growth. Analysis believes that the slow growth is due to the year-end sales and lunar new year holidays. Starting in March, more market demand is expected. In terms of car type, passenger cars and SUVs each accounted for around 50% and 40% in February.