The global semiconductor market reached US$575.1 billion in 2022, but the figure only covers the IC design and IDM sectors. The entire semiconductor value chain should come close to US$1 trillion if all the other sectors in the ecosystem, including wafer foundry, packaging, testing, equipment, materials and EDA/IP, are taken into consideration. In terms of the market, Taiwan accounted for only 8%. But in terms of the entire value chain, Taiwan had an over 17% share. And Taiwan leads anyone else in the world in advanced chip manufacturing processes; this is what makes Taiwan a global semiconductor powerhouse next only to the US.

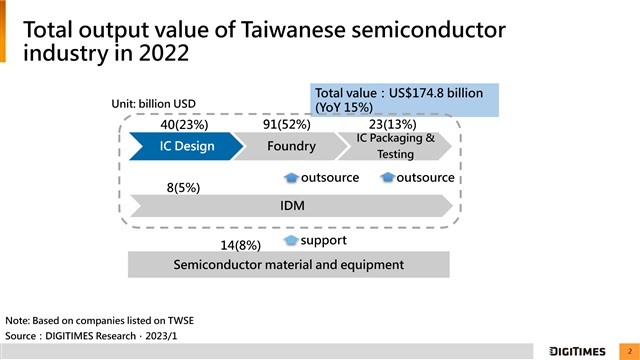

Taiwan's semiconductor output value totaled US$174.8 billion in 2022. The figure was compiled from the data reported by all publicly listed local semiconductor companies. Sales generated by foreign companies in Taiwan were not included, such as those by Micron, ASML and Applied Materials. If their operations in Taiwan are also factored in, the influence of Taiwan's semiconductor industry will be much bigger than commonly acknowledged.

The wafer foundry sector accounted for 52%, or US$90.9 billion, of Taiwan's semiconductor industry output in 2022. Packaging and testing houses contributed US$22.6 billion, or 13%, while IC designers generated US$39.8 billion for a 22.8% share. Taiwan boasts an advantage from an ecosystem within which different sectors are supporting one another. Taiwan may be a small country with a small population, but the compact size is exactly what makes it efficient.

IC design accounted for 2.4% of Taiwan's GDP, lower than semiconductor manufacturing's 6.8%, but higher than electronics manufacturing's 2%. Foxconn, Quanta, Pegatron, Compal and Wistron are the major players in the electronics manufacturing sector, making mostly notebooks, handsets, servers and industrial equipment, and their productions create enormous demand for components. The three sectors – IC design, semiconductor manufacturing and electronics manufacturing – generated 11.2% of Taiwan's GDP. Semiconductors also took up almost 40% of Taiwan's total exports and helped generate a trade surplus of almost US$100 billion. The semiconductor industry plays a vital role in Taiwan's economy.

We need to look at the added value of the IC design sector's GDP contribution. Taiwan's IC design sector employ almost 62,000 people, about 52,000 of whom are engineers. Such a small group of people contributes 2.4% of Taiwan's GDP, an incredible contribution that is rarely seen in other parts of the world. The Taiwan success story is inspiring the semiconductor dreams of many small and medium-size countries.

MediaTek chairman MK Tsai says the GDP per capita of Taiwan's IC design sector amounts to almost NT$20 million, outshining any others. In terms of R&D spending, the IC design sector devotes 28% of its sales to R&D, much higher than the wafer foundry sector's 14%. IC design is a sector that highly relies on top-notch workforces, and that is challenging for a country with an aging population and low birth rates. Himax CEO Jordan Wu and Phison CEO KS Pua, both of whom took part in the planning of an IC design industry white paper, noted that the biggest challenges facing Taiwan's IC design sector are insufficient talent supply, a lack of an overall strategic goal, and competition from China.

Credit: DIGITIMES