With tensions between Washington and Beijing taking center stage, concerns emerged regarding the status of supply chains and the competitive landscape among various Asian countries. To gain a more profound understanding of this situation, DIGITIMES conducted the "Asia Supply Chain: ASC 250 Rankings," with a specific focus on the Asian ICT industry chain and an analysis of the operational performance of nearly 5,000 companies.

Historically, Asian supply chains were predominantly led by East Asia. However, in the aftermath of the US-China trade war, supply chain management has become increasingly intricate. Production systems have expanded into regions like South Asia and Mexico, and the costs associated with green energy and product diversification have steadily risen. Consequently, the configuration of supply chains is undergoing transformations, necessitating further adaptations and strategic positioning by businesses. According to the ASC 250 study, among the top 11 economies in Asia, the top 250 publicly-listed companies in technology equipment, electronic components, automotive components, energy and power components, and more, hold significant positions.

Rank | Company | Country | Industry | Revenue | ||

2022 | 2021 | 2022 Net income | Growth rate | |||

1 | 1 | Toyota | Japan | Automotive Manufacturing | 271.1 | -3.9 |

2 | 2 | Samsung Electronics | South Korea | Tech Products and Equipment | 235 | -3.7 |

3 | 3 | Hon Hai Precision | Taiwan | Tech Products and Equipment | 221.7 | 3.3 |

4 | 4 | Honda | Japan | Automotive Manufacturing | 125.1 | -4 |

5 | 5 | SAIC | China | Automotive Manufacturing | 110.3 | -8.8 |

6 | 6 | Hyundai | South Korea | Automotive Manufacturing | 110.2 | 7.3 |

7 | 7 | Sony | Japan | Consumer Electronics | 81.4 | -9.5 |

8 | 15 | TSMC | Taiwan | Semiconductor | 75.8 | 33.4 |

9 | 11 | Foxconn Industrial Internet | China | Tech Products and Equipment | 75.8 | 11.1 |

10 | 8 | Nissan | Japan | Automotive Manufacturing | 74.4 | -6.3 |

11 | 9 | Legend | China | Tech Products and Equipment | 72 | -5.3 |

12 | 14 | Kia | South Korea | Automotive Manufacturing | 66.9 | 9.6 |

13 | 10 | Lenovo | China | Tech Products and Equipment | 66 | -6.4 |

14 | 13 | LG Electronics | South Korea | Consumer Electronics | 64.9 | 0.3 |

15 | 12 | Panasonic | Japan | Consumer Electronics | 62.6 | -5.3 |

16 | 29 | BYD | China | Automotive Manufacturing | 62.3 | 85.7 |

17 | 16 | Midea | China | Consumer Electronics | 51.6 | -3 |

18 | 48 | CATL | China | Electrical Components | 48.2 | 138.1 |

19 | 18 | Denso | Japan | Automotive Components and Equipment | 46.9 | -5.3 |

20 | 19 | Pegatron | Taiwan | Tech Products and Equipment | 44.2 | -2.2 |

In the ASC 250 list, the majority of companies hail from four regions: China, Japan, Taiwan, and South Korea, amounting to a total of 238 firms. In terms of supply chain rankings, Chinese companies dominate the list with 107 entries. Japan and Taiwan also boast a significant number of companies on the list, with 74 and 37 companies, respectively. However, South Korea, owing to the concentration of chaebols (large business conglomerates), has fewer entries, numbering only 20.

In terms of Southeast and South Asia, Eric Huang, the vice president of DIGITIMES, noted that locally publicly-listed companies tend to be smaller in scale and are often under the influence of foreign companies, particularly in the automotive sector. The ascension of local businesses hinges on whether foreign companies cultivate local design and procurement capabilities.

Among the top 20 companies in the rankings, the automotive supply chain and the technology supply chain each hold an equal share. Thanks to the rapid growth of the technology sector, relatively young tech companies have caught up with century-old automotive counterparts in terms of scale. In the automotive sector, the primary competition arises from Japan and South Korea, while the technology sector is primarily led by Taiwan.

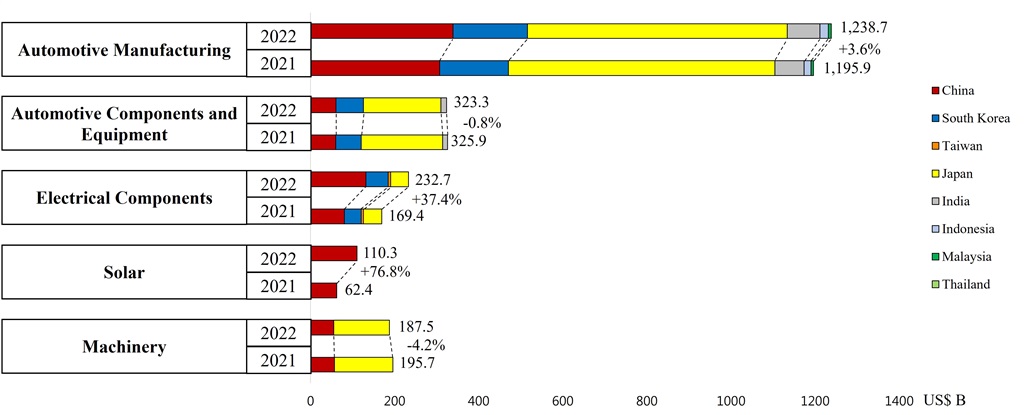

China has ascended to become one of the world's largest automotive exporters, intensifying competitive pressures on European automakers. Furthermore, China boasts the world's most extensive EV and EV component supply chain. It's noteworthy that China's EV market is twice the size of Europe's and six times that of the United States, with BYD and CATL establishing themselves as two major players. In particular, BYD achieved a remarkable annual growth rate of 80%.

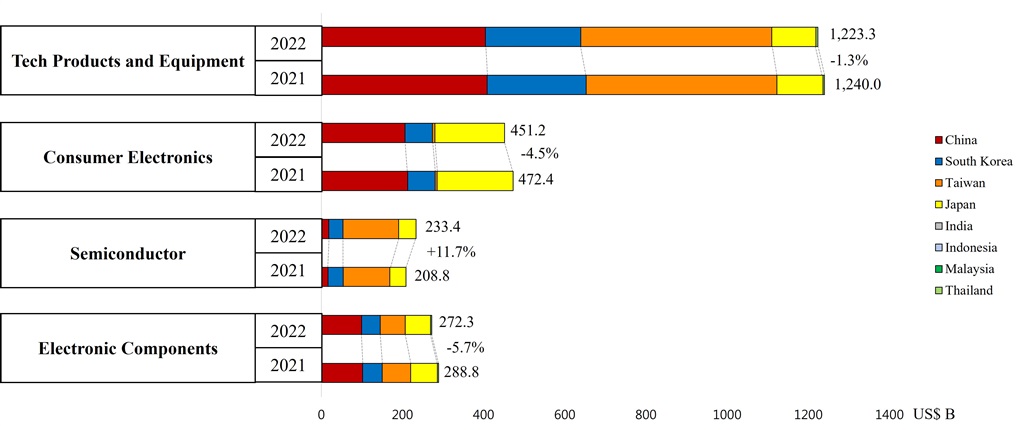

Analysis of tech industries by country, 2021-2022 (US$b)

Source: DIGITIMES Research

Regarding the value of production in individual countries, China has experienced the most substantial growth, primarily in sectors such as automotive manufacturing, electronic components, equipment and power components. This surge is attributable to the rapid expansion of the EV market, which has propelled China ahead of Japan in terms of production value. Meanwhile, Taiwan and South Korea have seen modest growth. The industries in China, Japan, and South Korea exhibit more diversity, including ICT and automotive components, whereas Taiwan predominantly concentrates on the technology supply chain.

Demand for technology hardware products varies across regions. In mature markets, there is declining demand in areas such as PCs and communications. In contrast, the automotive and industrial control sectors have exhibited more consistent performance.

Semiconductor foundries play a pivotal role in sustaining the entire supply chain. Foundries listed in the rankings experienced substantial growth in 2022, with an overall increase of 11.7%. This includes major players like TSMC, UMC, and SMIC, among others, all of which achieved annual sales growth exceeding 30%. Given their position at the pinnacle of the supply chain, these semiconductor foundries are less vulnerable to rapid declines in consumer demand compared to downstream customers.

However, an examination of operational performance in the first half of 2023 reveals that many ODM/EMS companies have experienced negative growth. While companies of European and American origin have demonstrated stability in the telecommunications and medical equipment sectors, Asian companies have primarily felt the impact of the saturated smartphone and computer markets. Nevertheless, some companies, such as Luxshare-ICT and BYD, have achieved double-digit growth, particularly in the fields of electronics manufacturing and automotive.

Analysis of auto, energy, and machinery industry by country, 2021-2022 (US$b)

Source: DIGITIMES Research

Huang noted that despite the overall ICT industry having passed its low point, the upward momentum remains insufficient. It is likely that genuine industry recovery may not materialize until the latter half of 2024. However, the high-end AI server segment experienced a breakthrough in growth last year and is expected to continue growing at a rate of 128% next year. In this realm, except for a few major American chipmakers, most of the supply chain is led by Taiwanese companies, which constitutes a prominent feature of Taiwan's supply chain. Although the AI server market is performing strongly, it cannot single-handedly drive the growth momentum of the entire ICT industry.

The global IC product market is undergoing significant reshuffling due to regulatory measures imposed by the United States. China's semiconductor industry is rapidly expanding, particularly in the area of equipment procurement, surpassing the growth rate of the global semiconductor equipment market in 2022. This trend is especially evident in Chinese semiconductor equipment manufacturers such as Naura Technology, particularly in the first half of 2022 and 2023, reflecting strong government support for this industry.

China has effectively leveraged its vast market and policy support to nurture EVs, batteries, and energy storage as the primary driving forces for manufacturing industry transformation and upgrading. If the Chinese government continues to back the automotive and industrial control sectors, the legacy chips market may witness substantial changes, akin to how Chinese companies have dominated markets, such as LEDs, panels, and solar panels, gradually capturing market share from other international competitors.

In the automotive and EV supply chain, China, Japan, and South Korea hold sway. China has achieved remarkable milestones, particularly over the past decade, surpassing Japan, signifying a significant shift. In the first half of 2023, the performance of automotive manufacturers exceeded expectations, especially Chinese automotive battery manufacturers, who achieved revenue growth rates ranging from 40% to 65%.