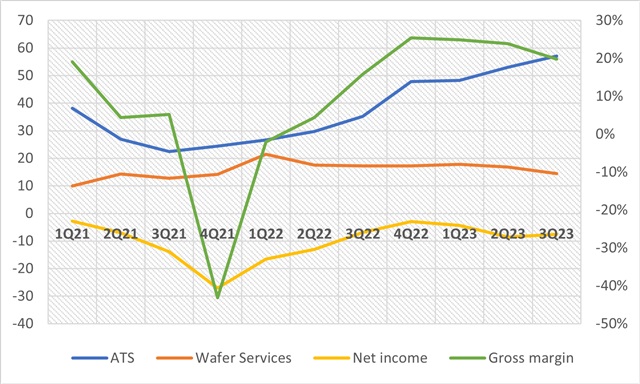

US foundry SkyWater Technology has released its financial results for the third quarter of 2023 on November 8. On a GAAP basis, the foundry saw US$72 million in revenue, marking another record for quarterly revenues and fifth quarter of sequential growth.

As a DMEA-accredited Category 1A Trusted Foundry, SkyWater believes that it is on track to exceed its long-term revenue growth target of 25% annual growth. For third-quarter 2023, gross margin was 19.8% and net loss was US$7.6 million. Year-to-date revenue has been US$208 million, up 40% year-on-year, surpassing the company's expectation.

Together, Advanced Technology Services (ATS) and Wafer Services businesses make up SkyWater's Technology as a Service (TaaS) business model. The ATS focuses on joint R&D between SkyWater process integration teams and customers, while Wafer Services supply customers with ICs.

Defense business continues to run hot in 2024

For third-quarter 2023, ATS revenue was US$57.1 million, a 8% sequential increase, while Wafer Services revenue was US$14.5 million, a 14% sequential decrease. "The sequential growth in our ATS business demonstrates that our customers' innovation investments remain strong despite the incremental softening in end market demand since our last call," said Thomas Sonderman, SkyWater President and CEO, at the company's third-quarter earnings call on November 8. The significant yearly ATS growth over 60% mainly came from multiple strategic aerospace and defense programs, noted Sonderman.

Sonderman believes that the aerospace & defense business will continue to run hot next year. Fast forward to 2025, SkyWater's RadHard platform will come online, along with its readout IC and focal plane array thermal imaging platforms tied to Department of Defense programs. SkyWater seeks to maintain healthy levels of revenue coming from the defense customer base while growing the commercial base, eventually aiming for a 60-40 revenue split between the two. "It will take a couple more years to get that balance," said Sonderman.

Nevertheless, the overall macroeconomic weakness and slowing consumer demand environment, especially from the automotive and industrial sectors, have left their marks on SkyWater's Wafer Services revenue. Further decline in Wafer Services revenue is expected in Q4, and SkyWater expects Q4 revenue in the range of mid-US$70 million. "The automotive and industrial sectors are now beginning to feel the effects of the correction that's been going on for multiple quarters," Sonderman remarked, "given our concentration in that space, we are now seeing those effects as well."

Tool sales increase as customers prepare for ramp in 2025

Notably, within the ATS business, SkyWater anticipates a significant increase in tool investments over the next several quarters as consumers seek production ramps of multiple products and platforms developed in SkyWater. "Tool sales have historically been infrequent and viewed by management as secondary to ATS development revenue," noted SkyWater Chief Financial Officer Steve Manko, "Recently, our ATS customers have stepped up their commitment to fund tool purchases, and we expect this trend to continue going forward."

Though the CFO expects tool sales to decline sequentially in first-quarter 2024, he believes it can increase significantly in second-quarter 2024 and beyond. Sonderman added that the majority of tool sales are coming from the US Department of Defense and aerospace & defense programs, though they can be used for commercial customers as well. "A lot of the gains we're seeing now are resulting from the tools that were coming in 2021," explained Sonderman, indicating that while tool sales were relatively low in 2022, it's beginning to pick up as 2023 comes to a close, and the tools installed on 2024 will begin to pay dividends in 2025 and beyond.

Overall, with the momentum in ATS, combined with tool sales, SkyWater expects to continue outperforming the overall industry in revenue growth in 2024.

In what he called a "paradigm shift in the foundry business," the SkyWater President explained how the foundry shifted the risk of equipment purchase from manufacturers to customers by getting them to invest in the tools. "Traditionally, the semiconductor manufacturer always had to go buy the equipment, and then they would recoup that investment when volumes materialized. They were taking all the risk," said Sonderman at the earnings call. "When customers are investing in these tools, it shows that they're committed to the tools and the products that will be developed."

Ultimately, according to Sonderman, SkyWater's goal now is to "move programs out of ATS into Wafer Services, prepare for the ramps that are coming in 2025", and it expects the tool investment in 2024 to position SkyWater for the second half of the decade.

SkyWater's ATS business continues to grow (Unit: US$M)

Source: SkyWater financial data, assembled by DIGITIMES