As the global floating offshore wind industry gears up for explosive growth, Taiwan is positioning itself at the forefront of this renewable energy revolution.

With Bloomberg NEF projecting global floating wind capacity to surge from 0.4 GW in 2025 to a staggering 80 GW by 2040, Taiwan is laying the groundwork to capitalize on this burgeoning sector. At a recent forum titled "Realizing Floating Offshore Wind in Taiwan," Dr. Chung-Hsien Chen, Director of Taiwan's Energy Administration, unveiled ambitious plans for a Floating Offshore Wind (FOW) Demonstration Program as fixed-bottom offshore wind capacity depletes.

This initiative aims to jumpstart the industry and contribute significantly to Taiwan's 2050 net-zero emissions target. Targeting 6-12 floaters with a capacity of 90-180MW for each application, the government plans to reveal feed-in tariffs and tender rules by the third quarter or fourth quarter of this year, with project completion targeted for 2029-2030, according to Chen.

Eight floating wind farms have already obtained site planning documentation. These sites, primarily near Hsinchu and Miaoli counties, boast a combined capacity ranging from 0.75 GW to 1.8 GW.

However, Chen acknowledged four significant challenges in developing FOW in Taiwan: regulation, economy, technology, and infrastructure. Key issues include clearer guidelines on fishery co-prosperity, subsea cable management, and floating foundation transport regulations.

The economic viability of projects remains a critical factor. Taiwan is exploring innovative incentive structures, potentially combining feed-in tariffs with one-time subsidies to ensure reasonable profit margins for developers. This approach aligns with global trends, as evidenced by the recent commercial-scale floating wind tender in Brittany, France, which set a new benchmark with a record-low subsidy contract price.

As the industry matures, expect to see consolidation among the 60+ floating foundation designs currently in development. Semi-submersible platforms are emerging as early favorites, but site-specific conditions will likely prevent complete standardization.

Technologically, Taiwan must adapt to its unique environmental conditions. The focus is on developing suitable foundation types, mooring technologies, and anti-typhoon/seismic measures.

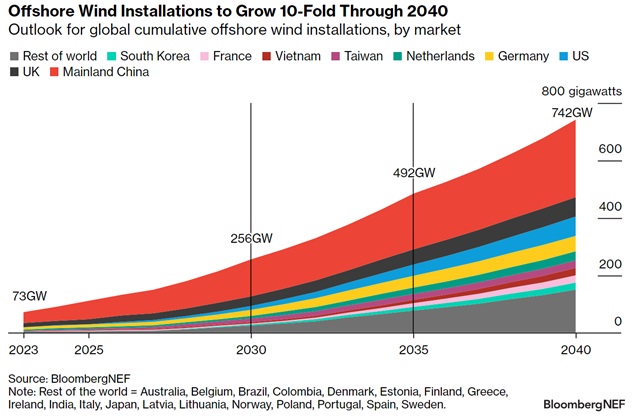

Asia is emerging as a critical battleground for floating wind, with Bloomberg NEF expecting the region to install 41 GW by 2040. While China is projected to lead with 28.3 GW, Taiwan's strategic planning and early adoption could position it as a significant player in the market.

With the total offshore wind capacity projected to reach 742 GW by 2040 and floating offshore wind expected to constitute 11% of this capacity, Taiwan's bet on floating offshore wind could play a crucial role in both its domestic energy transition.