With China being the world's IT production center and a country with some of the strongest consumer demand, along with benefits on custom tax, funding, loans, and subsidies provided by the government, China's FPD industry continues to show strong growth. Local firms such as BOE, CSOT, Tianma Microelectronics, and CEC Panda have been aggressive in developing 6G and above LCD panel production lines. This Digitimes Research Special Report analyzes the current FPD players in China and forecast how China's industry will progress through 2017.

Chart 4: China LCD self-sufficiency rate by application, 2012-2013

Chart 9: BOE, TCL and Tianma operating income, 2011-2014, (CNYm)

Chart 10: BOE revenues from major customers, 2010-2014, (CNYm)

Chart 12: BOE panel shipments by application, 2012-2017, (k units)

Chart 14: CSOT LCD TV panel capacity and global share, 2011-2017 (km2)

Chart 16: Major China LCD makers' operating income, 2011-2013, (CNYm)

Chart 17: Major LCD makers' non-current liabilities, 2011-2013 (CNYm)

Chart 20: TCL LCD TV shipments, including brand and OEM, 2010-2015 (k units)

Chart 21: China UHD LCD TV panel demand, 2013-2017, (m units)

Chart 23: CSOT Wuhan joint venture 6G fab source of investment funds

Chart 24: CEC Panda panel shipment, by application, 2013-2017 (K units)

Chart 27: Tianma top-5 customers and share of shipments, 2014

Chart 29: Tianma LCD shipments by application, 2013-2017 (k units)

Chart 30: IVO LCD panel shipments by application, 2013-2017 (k untis)

Chart 32: Global share of China LCD makers, 2012-2017 (Km2/year)

Chart 33: Global share of China-based LCD capacity, 2011-2017

Chart 34: China large-size LCD panel shipments, 2012-2017 (K units)

Chart 35: Local China large-size LCD panel shipments, 2013-2017 (K units)

Chart 36: Mainland China S&M panel shipments by application, 2012-2017 (K units)

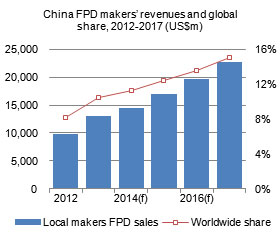

Chart 39: Mainland China FPD makers' revenues and global share, 2012-2017 (US$m)