China-based handset makers have been rapidly increasing their shipments over the past few years and have been introducing high-end smartphone products with specifications that are comparable with international brands.

On the other end of the market, the price of mid-range smartphones from China-based brands have been lowered to CNY800/unit (US$130/unit) from CNY1,000/unit. In addition, to replace feature mobile phones, China-based handset makers have introduced entry-level low-priced smartphone models with a retail price of CNY400/unit for export to emerging markets, as well as for third- and fourth-tier cities in China where infrastructures are less developed. The factors aforementioned mean the quality and price pressure on China-based smartphone panel makers has been growing.

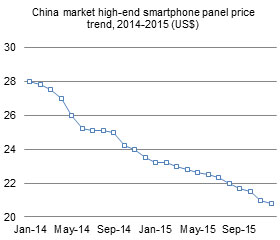

Digitimes Research predicts by the end of 2015, the price of Full HD panels for high-end smartphones in China will drop below US$21/unit, an annual decrease of around 11.5%. The price of HD panels for mid-range smartphones and WVGA panels for entry-level smartphones will fall to US$11/unit (an on-year decrease of 10%) and US$3/unit (an on-year decrease of 25%), respectively.

BOE and Tianma have addressed the move to the higher-end by building 5.5G LTPS TFT LCD production lines and have achieved mass production since 2013-2014. For demand for mid-range smartphone panels, BOE aggressively increased the proportion of smartphone panels from its 6G production lines.

BOE has been benefitting from increasing production efficiency at its 6G production lines and its shipment share of HD-level smartphone panels is forecast to reach beyond 40% by the end of 2015.

Tianma has also benefitted from the support of its LTPS TFT LCD capacity and by the end of 2015, its shipment share of Full HD-level smartphone panels is expected to reach 6.5%.

IVO only has one 5G a-Si TFT LCD production line and has been focused on supplying panels to entry-level smartphone makers in southern China. However, China's feature mobile phone market has been transitioning to entry-level smartphones; hence in the beginning of 2015, the shipment share of entry-level smartphone panels from IVO is predicted to exceed 30% and will continue growing. The figure is expected to grow to 35.4% by the end of 2015.

Table 1: China handset panel makers 5.5G LTPS TFT LCD plans, 2014-2015

Chart 1: China panel makers shifted to thinner, higher-resolution panel production in 2H14

Chart 3: China market high-end smartphone panel price trend, 2014-2015 (US$)

Chart 4: China market mid-range smartphone panel price trend, 2014-2015 (US$)

Chart 5: China market entry-level smartphone panel price trend, 2014-2015 (US$)

Chart 6: BOE panel shipments by market segment, 1Q14-4Q15 (k units)

Chart 7: Tianma panel shipments by market segment, 1Q14-4Q15 (k units)

Chart 8: IVO panel shipments by market segment, 1Q14-4Q15 (k units)

Chart 11: Tianma handset panel shipments, 1Q14-4Q15 (k units)

Chart 15: Huawei panel supplier breakdown, 2014-2015 (k units)

Chart 16: Lenovo panel supplier breakdown, 2014-2015 (k units)

Chart 17: Coolpad panel supplier breakdown, 2014-2015 (k units)

Chart 20: Xiaomi panel supplier breakdown, 2014-2015 (k units)