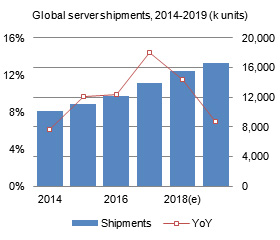

Overall revenues from Taiwan's server sector are expected to rise over 20% on year in 2018 with server shipments increasing over 10% on year, according to Digitimes Research figures. For 2019, Taiwan's server shipments will pick up another 7% on year.

The Wistron Group (Wistron plus Wiwynn) and Quanta Computer have seen increasing revenue contributions from their server businesses in 2018. For Inventec and Foxconn Electronics (Hon Hai Precision Industry), their server revenue proportions are expected to be flat from a year ago.

Mitac has seen the proportion of revenues from the server business slipping. Its server business cover server motherboards, end systems, storage devices and network equipment.

In terms of shipments, Quanta and the Wistron Group are also expected to have on-year growths higher than the others in 2018, followed by Foxconn and Inventec. For 2019, Quanta is expected to perform the best, and the Wistron Group will come in second in terms of growth, according to the figures from Digitimes Research.

Quanta's shipment growth in 2019 will be driven mainly by orders from US-based first-tier datacenter clients and demand from telecommunication equipment suppliers who will begin preparing solutions for the upcoming 5G era. The Wistron Group will see its shipment growths primarily coming from Wiwynn.

Chart 2: Taiwan server-related revenues by maker, 2014-2019 (NT$b)

Chart 3: Taiwan server-related revenue share by maker, 2014-2019

Chart 5: Global server shipments by client type, 2015-2019 (k units)

Chart 6: Global server shipment share by client type, 2015-2019

Chart 7: Global server shipments by client, 2017-2019 (k units)

Chart 9: Taiwan server shipments by maker, 2015-2019 (k units)

Chart 19: Inventec server shipments by client, 2015-2018 (k units)

Chart 22: Wistron server shipments by client 2015-2018 (k units)

Chart 25: Foxconn server shipments by client, 2015-2018 (k units)

Chart 28: Quanta server shipments by client, 2015-2018 (k units)

Chart 31: Mitac server shipments by client, 2015-2018 (k units)

Chart 33: Global datacenter server shipment share by cloud/self-built type, 2006-2021