The Outline of the Program for National Integrated Circuit Industry Development China released in 2014 specified that efforts would be made toward building a complete semiconductor industry ecosystem with IC design in the lead, fabrication as the basis, and semiconductor equipment and material as the support. This highlighted IC design's role as a bellwether leading China's efforts to strengthen its semiconductor industry development.

Specifically, the 13th 5-year Plan (2015-2020) set the goal for China's IC design industry to focus efforts on developing chips for smart mobile devices and network communication equipment. The aim was to boost the technological strength and competitiveness of China's IC design industry through the research and development of chips for smart mobile devices, network communication equipment, smart wearable devices and corresponding operating systems.

On top of the aim to build a strong foundation for China's IC design industry development through smart device chip RD, the policy planning further looked to expand the use of domestically developed semiconductor solutions to cloud computing, IoT, big data analytics and other emerging applications.

It was also looking to buoy demand for IC manufacturing, assembly as well as semiconductor equipment and material, as China tried to achieve the goal of semiconductor self-sufficiency.

IC self-sufficiency remains one of the major goals of China's 14th 5-year Plan (2021-2025). In terms of chip applications, 5G, AI and other emerging applications have tremendous opportunities, forming a key focus of the 14th 5-year Plan. However, as China relies on foreign foundry service providers for the manufacturing of high-end 5G and AI chips, there is concern that its progress will be held back by the US. In fact, how far China can achieve IC self-sufficiency will depend on how far it can "de-Americanize" its semiconductor supply chain.

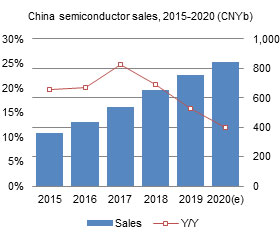

Semiconductors' vital role to China's industrial and national development is clear amid the country's trade war with the US. This Digitimes Research Special Report reviews the results of China's efforts to build its semiconductor ecosystem during the 13th 5-year Plan (2015-2020), and looks at the plans set out in its 14th 5-year Plan (2021-2025) to raise its IC self-sufficiency.

Table 1: Development targets of China's semiconductor industry, 2015-2020

Chart 2: China semiconductor sales from IC design industry, 2015-2020 (CNYb)

Chart 3: China semiconductor sales from IC manufacturing industry, 2015-2020 (CNYb)

Chart 4: China semiconductor sales from IC packaging/testing industry, 2015-2020 (CNYb)

Chart 5: China semiconductor sales share by industry, 2015-2020

Chart 7: China semiconductor import/export amounts, 2015-2019 (US$b)

Table 2: China IC self-sufficiency rates by IC type during 13th 5-year Plan

Table 4: Global major foundries' manufacturing process roadmap, 2015-2020

Chart 8: Global market shares of NOR flash makers, 2016, 3Q19

Table 6: Global major 3D NAND flash maker technology roadmap, 2015-2020

Table 7: Global major DRAM maker technology roadmap, 2015-2020

Table 8: Comparison between China and global packaging and testing firms in technologies

Table 10: China major semiconductor material and equipment supplier revenues, 2019 (US$b)

Table 11: Global semiconductor material suppliers and market share

Table 12: Global semiconductor equipment suppliers and market share

Influences on China IC manufacturing and packaging/testing industries

Table 15: SMIC's semiconductor material and equipment partners

Table 17: Major open-source ISAs and their Chinese developers

Table 18: Comparison of Chinese IC designers' operation between 13th and 14th 5-year Plans

Table 19: Global major foundries' manufacturing process roadmap, 2021-2025

Table 21: China's key deployments of semiconductor materials and equipment in 14th 5-year Plan

Table 22: China semiconductor industry development targets for 14th 5-year Plan