Chinese semiconductor industry research firm JW Consulting recently released a report covering 742 investment projects in 25 Chinese provinces and regions implemented 2021-2022, and showed that more than CNY2.1 trillion (US$290.8 billion) was allocated to semiconductor-related investment, in which one-third of the fund was for semiconductor equipment and materials.

Those 742 projects covered various semiconductor-related investments, including panel displays, wafer foundry, storage devices, integrated device manufacturing (IDM), device/chips, platform/base, semiconductor equipment, semiconductor materials, packaging and testing.

The stats showed that investment projects for semiconductors in China have been on the rise year on year. In 2021, there were 142 new projects and 187 continuing projects. In 2022, new projects increased to 160, whereas the number of continuing projects totaled 352.

Anhui and Guangdong are the two provinces that saw the most significant increase in semiconductor investment projects over the two-year period. Anhui embarked on 304 new semiconductor investment projects during the said period, with investments totaling CNY425.6 billion while Guangdong started 66 projects (CNY342.3 billion).

Affected by geopolitical factors coupled with the downturn of the chip market business cycle, China's semiconductor industry development focus is gradually shifting upstream. During 2021-2022, there were 176 semiconductor materials projects and 56 equipment projects, they took up a combined share of more than 30% of the 742 projects in total.

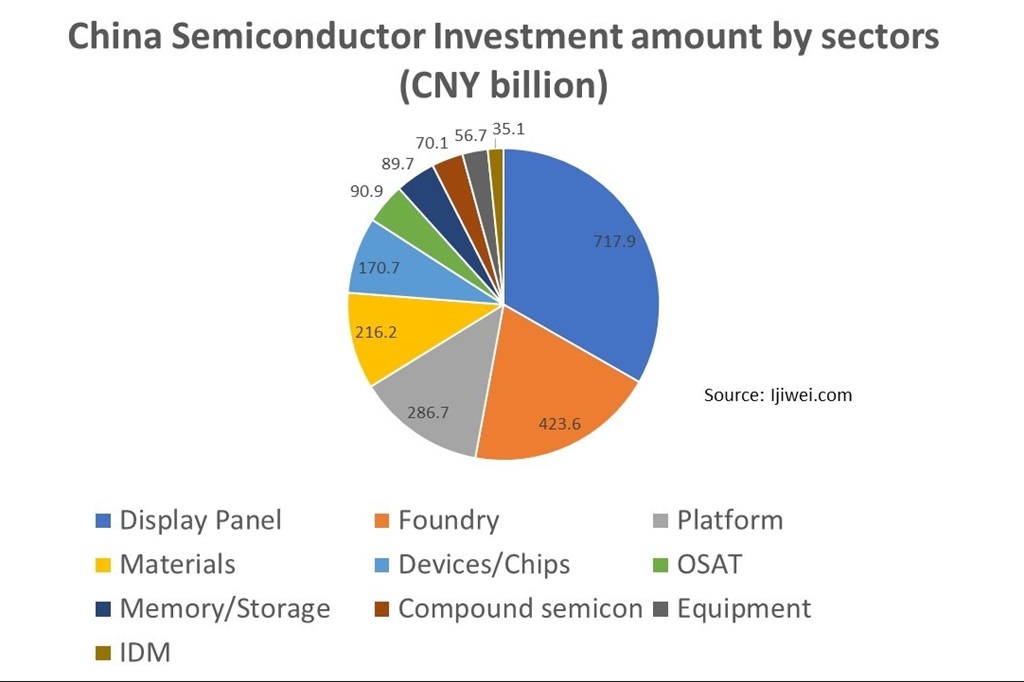

China's semiconductor investments by sectors during 2021-2022

Projects | |

Material | 176 |

Display Panel | 172 |

Devices/Chips | 135 |

OSAT | 85 |

Platform | 68 |

Equipment | 56 |

Compound semiconductor | 21 |

Foundry | 17 |

IDM | 7 |

Memory/Storage | 5 |

Source: Ijiwei.com

In comparison, during 2016-2020, there were only 40 semiconductor material projects and 7 equipment projects, accounting for a total of 15.6%.

After experiencing a wave of bankruptcy and shutdowns, China's semiconductor investment is now mainly concentrated on cluster development, and the industry has calmed down from the period of blind frenzy into a more rational period, said the report.

China's semiconductor investment has gradually shifted from downstream end products to upstream equipment and material supply. There are also "underlying levels of technological innovations" in the semiconductor industry, according to the report, without giving details.

The report said local governments have paid attention to policy improvements that are accelerating the growth of major semiconductor projects in each province, and the industry has changed from the mindset of doing work individually to a more reliable synergy formed by multiple forces.

Source: ijiwei