When the race towards carbon neutrality is seen as an adversity by some, others see it as an advantage. For global automotive semiconductor leader STMicroelectronics (ST), which started to take sustainability high on the agenda more than 20 years ago, ESG gives it an upper hand to maintain the lead and stay in the game.

Francesco Muggeri, STMicroelectronics' vice president of Marketing and Applications, Power Discrete & Analog, APAC., pointed at the watch on his wrist in the press conference of ST Tech Day in Taipei on November 2 and said, "When the company claimed its watch to be 100% carbon neutral and required all its suppliers to become carbon neutral, a chain reaction has been ignited."

"ST is ready to become carbon neutral by 2027. Among all semiconductor makers, how many will be carbon neutral before 2027? No one. And the next semiconductor manufacturer claiming to achieve that will have to wait until 2030," said Muggeri. "We have started this journey more than 20 years ago, thanks to our visionary CEO. ST has a lot of value to deliver to our clients."

He added that at Apple's Scary Fast MacBook Pro launch event recently, the power consumption efficiency of the M3 chip of Apple was also a focal point. In other words, sustainability has become one of the critical determinants of customers to select suppliers for their supply chain. It is a kickoff of a big change, that ESG practices will impact the survival of manufacturers, and all companies must strive to go green.

Carmakers seek to control semiconductor supplies

A trend among smartphone companies to design their proprietary processors raised questions about whether automotive companies will also follow suit to design their own chips to differentiate themselves from competitors, thus bypassing automotive chip companies and going directly to wafer foundry makers to produce their chips. Although Muggeri agreed that there is a trend of "verticalization" in the automotive industry, he said it will be an opportunity rather than a challenge for ST.

Muggeri said the lesson learned by automakers during the Covid chip shortage is that they can no longer treat semiconductors just as other components and the shortage demonstrated that they need to have more control over the supply chain. The automakers have been building a closer tie with semiconductor suppliers now so that they can create value together. He stressed that the auto-grade specifications are not easy to meet, and the automakers or even Tier 1 companies know the complexities of manufacturing semiconductors, but they don't have the know-how to do it.

"We are also working with some packaging and module makers in Taiwan in materials innovations," said Muggeri. "So we don't see it as a challenge at this moment, but actually we see a huge opportunity."

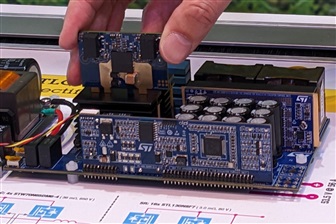

At the exhibition venue of STMicro's Taiwan Tech Day, an ST engineer demonstrated that a packaged GaN chip can easily replace the much larger silicon version and have much better energy efficiency.

Credit: DIGITIMES

Indeed, the electrification and digitalization of automotives have given automotive chip manufacturers a boost in growth in terms of the semiconductor contents of a car.

STMicro data showed that the average number of semiconductor chips per car had doubled during the 2017-2021 period, and expectations for further acceleration are expected to happen in the next few years.

Danny Lee, marketing director of Automotive Sub Group APeC of STMicro gave the example of cars of L2 and L4 autonomous driving, saying that the transition would create 2.5x of incremental demand for semiconductor content, let alone potential upside of using more GPUs, sensor fusion and Radar systems.

"Software-defined vehicle architectural change has multiplied our revenues five times," said Lee.

In traditional applications, additional and more complex ICs are required for the same Electronic Stability Control functionality for a next-generation automobile as one built in 2018. For example, the MCU spec will be triple core; 400 MHz; 6-8MB for next-gen autos, compared to single core; 120 MHz; 1 MB of an MCU in 2018. A next-gen auto requires 3 MCUs and about 13 ICs to achieve the Electronic Stability Control functionality, compared to 1 MCU and 3 ICs in 2018.

ST enjoys more than 50% of the market share in automotive and industrial semiconductors, with revenues projected to exceed US$1 billion in 2023, and remains the world's leader in the SiC MOSFET market. It has increased SiC capacities 10 times over the past 10 years and is aggressively pursuing GaN development. ST projects a 70x growth in global GaN market size (from US$0.126 billion to US$2.1 billion) between 2021 to 2027, with a compound annual growth rate of 59%.