Senior Indian semiconductor officials said on September 11, 2025, that Foxconn remains "completely upbeat" about its expansion plans in India despite being forced to send Chinese workers back to China earlier this year, describing the disruption as manageable amid ongoing geopolitical tensions.

The reassurances come after Foxconn subsidiary Yuzhan Technology recalled roughly 300 Chinese engineers from its India facility, marking the second such instance in recent months, sources told the Economic Times. The move reflects Beijing's broader strategy to control technology transfers to emerging manufacturing hubs like India, with Chinese authorities reportedly asking Foxconn chairman Young Liu to submit a report detailing the company's investments in India.

Operations weather disruption smoothly

"Operations did not really suffer significantly on account of that," said S. Krishnan, Secretary of India's Ministry of Electronics and Information Technology, speaking to reporters during a visit to SEMICON Taiwan 2025. "Foxconn has been in their plant near Chennai for the last five years. A new plant is coming up near Bangalore."

Krishnan said Foxconn managed operations "with some of the workers there, some people from Taiwan, and some people from the United States," adding that "the disruption was not really major."

The comments underscore India's efforts to reassure international investors about its semiconductor ambitions as geopolitical tensions complicate global supply chains. Krishnan noted that while India imposed visa restrictions on Chinese nationals, "no such restriction was imposed on Taiwanese investments."

He explained that while India was "making it difficult for Chinese nationals to get visas to come into India," the electronics sector was granted exceptions because "electronics was one of the few sectors where we actually needed them." India's Ministry of Electronics became "one of the most proactive ministries to enable issue of visas to Chinese nationals to come into India for business or work purposes to establish these new manufacturing facilities," he said, noting that "the largest number of visas were issued for people in this sector."

He characterized the Foxconn situation as an exception, saying other Taiwanese companies, including Delta Electronics, had "no issues" bringing Chinese workers to India. "The issue has always been with Foxconn," Krishnan said, questioning whether the problem stemmed from China's relationship with Foxconn or Apple rather than with India.

"So now, is it an issue that China has with Foxconn, or China has with Apple, is the real question," he said. "I don't think it's an issue with India in that particular respect."

Ambitious phase 2 expansion takes shape

Indian officials used the Taiwan visit to outline ambitious plans for the second phase of the India Semiconductor Mission, which will dramatically expand beyond the current focus on fabrication facilities.

"India phase 2 will cover all aspects," said Amitesh Kumar Sinha, CEO of the India Semiconductor Mission. "It will cover silicon fab, memory fab, display fab, and compound semiconductors. Then OSAT, advanced packaging, and more so."

The expanded program will also extend benefits to equipment manufacturing, research and development, chemicals, gases, materials, and facility setup, Sinha said, describing it as covering "everything that is required for the semiconductors."

Phase 1 is "about to close," with final approvals expected within one to two months and the new phase starting concurrently, Sinha said. "We are in the process of finalizing that policy. We have got partial approval."

Current progress shows strong momentum

Under Phase 1, India has approved 10 semiconductor projects with a combined investment value exceeding US$15 billion. The flagship project is a joint venture between Tata Electronics and Taiwan's Powerchip Semiconductor Manufacturing Corp (PSMC) for India's first commercial silicon fabrication facility, capable of producing 50,000 wafers per month across nodes from 110 nanometers to 28 nanometers.

Other major projects include a US$2.7 billion memory packaging plant by Micron Technology and a US$3.25 billion assembly and test facility by Tata in Assam.

The government is also supporting the design ecosystem, providing free access to electronic design automation tools to more than 285 colleges and 73 startups. Students logged 14 million hours of EDA tool usage in the first eight months of 2024, with their chip designs being fabricated at government facilities.

Taiwan visit yields strategic insights

Officials said their participation in SEMICON Taiwan 2025, held September 10-12, 2025, provided valuable insights for India's semiconductor strategy.

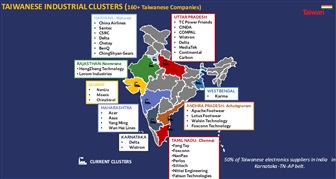

"The one thing that we observed is how rich the Taiwanese ecosystem is in the space of electronics and semiconductors," Krishnan said. "The depth of companies and the depth of technology that is here, how there are several niche technologies, particularly in the compound semiconductor space."

Sinha highlighted Taiwan's investment in R&D as "driving the modern technology and keeping Taiwan ahead with respect to other countries," identifying research and development as "an area where we would also like to invest in the future."

The visit also underscored the importance of academic-industry alignment, with Krishnan noting how "world-class universities which have been set up alongside the Hsinchu Tech Park" work closely together.

Roadmap focuses on building solid foundation

Addressing recent media reports suggesting India aims to quickly transition from 28nm to 5-7nm chip production, Krishnan said such claims were misrepresented.

"We believe that we need to build a base first," he said. "All told, India as a country is a lower-middle-income country currently. And we have a number of demands on resources, fiscal resources in the country."

He explained that fabrication costs "rise almost exponentially as you go to the leading-edge nodes," with major cost increases at 28, 14, 7, and 5-nanometer transitions.

Trade outlook remains positive

On the potential US Section 232 tariffs, Krishnan said companies with American investments "seem to be fairly protected from any new tariff implications," citing recent positive signals in India-US trade discussions.

Officials also detailed India's Electronic Component Manufacturing Scheme, launched 2.5 months ago to boost local production of printed circuit boards, display assemblies, camera modules, and other components. The goal is to double value addition in electronics from the current 15-20% to 35-40%, excluding semiconductors.

"The basic goal that we have is to increase the value addition in India," Krishnan said, noting that several Taiwanese companies, including Foxconn, have applied under the scheme.

The six-year program reflects India's recognition that "everywhere these are global value chains" that cross multiple borders, but aims to ensure the industry "drops deep roots in India and stays there."

With Phase 1 nearing completion and Phase 2 preparations underway, Indian officials expressed confidence that their semiconductor strategy will create a robust ecosystem capable of supporting both domestic demand and global supply chains.

Credit: ITA

Article edited by Jack Wu