Digitimes Research estimates that the global LTE market doubled in size to 445 million users in 2014 and we further forecast that annual growth in the number of LTE users will remain above 70% between 2015-2016, with the overall market reaching 1.466 billion users by 2016, representing 70% of the total number of global mobile broadband (including 3G+4G) users. Driving that growth is the Asia-Pacific region, especially China, and the region will surpass North America to become the world's largest consumer LTE market in the first half of 2015.

Chart 2: Asia-Pacific region to become largest consumer LTE market in 1H15

Chart 3: TD-LTE-Advanced lagging FD-LTE by more than three years in development cycle

LTE networks accelerate data traffic but 4G profit models still not clear

Chart 5: Slow value-added LTE service development means lackluster revenue growth for operators

Chart 6: Lack of low-frequency spectrum resources could become developmental disadvantage for TD-LTE

Indoor coverage drives domestic networking and communications industry

Chart 8: China mobile handset subscriber data, 2009-2015 (m users)

Chart 9: China Mobile strategies to accelerate a 4G switch, 2014

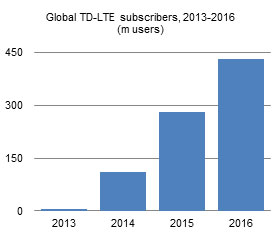

China Mobile shifts global TD-LTE subscriber market focus to Asia Pacific

Speeding up increase of availability of TD-LTE end device models

Chart 11: TD-LTE subscribers and regional distribution, 2012-2016

Chart 13: MIIT issued permits for FD/TD-LTE duplex networks in two stages in 2014

China trying to boost 4G subscribership with low-cost 4G smartphones

Chart 14: TD-LTE end device models and device-type share, 3Q12-3Q14

Chart 15: Taiwan makers' LTE products, output value, 2011-2014

High growth of mobile data but revenues and profits fall short of expectations

Table 1: Operator level 4G LTE indoor network coverage solutions

Three Musketeers: MediaTek, Marvell, and Intel drawing their swords

LTE application services as product differentiating features

Chart 20: Competition between Qualcomm and MediaTek will escalate in 2015

Huawei seeks to have a bigger say in setting international standard in 2015

Trying to take on a leading role in international standard settings (2014-)

Chart 22: Worldwide LTE equipment vendor market share, 2011-2014

Chart 23: Huawei's three stages of strategic goals, 1H10-2H14