Taiwan-based server manufacturers' revenues generated from server-related business, including motherboards, racks, storage devices and network equipment, kept growing to reach NT$887 billion (US$29.64 billion) in 2019, up 2.3% year-over-year. Their revenues outperformed their shipments (down 1.4% year-over-year) mainly due to enhanced product spec and increased sales of storage and network devices.

Going forward into 2020, rebounding market demand will boost Taiwan-based server manufacturers' revenues by 6%-7% year-over-year. Server shipments will also resume growth. Both Taiwan-based manufacturers' shipments and global shipments will show over 6-8% increases.

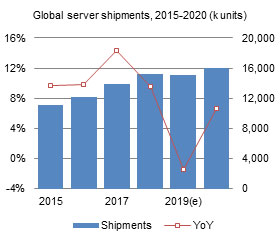

In terms of server shipments, as some customers placed more orders than what they actually needed over the past two years, they turned more conservative with their orders in 2019, resulting in a decline in global server shipments. Going forward into 2020, after a year of inventory depletion, server shipments will likely exhibit positive growth. As a matter of fact, the market was already showing signs of recovery from both the customer and manufacturer sides in fourth-quarter 2019.

The growth in server demand in 2019 still came mainly from US-based large-scale data center operators including Facebook and Amazon. China-based vendors including Lenovo and Inspur also showed strong demand/shipments as they benefited from Huawei's lost market share due to the US trade ban. Looking into 2020, US-based large-scale data center operators will still be the major force driving server shipments while Huawei will recover lost ground.

Chart 2: Taiwan server-related revenues by maker, 2014-2019 (NT$b)

Chart 3: Taiwan server-related revenue share by maker, 2014-2019

Chart 5: Global server shipments by client type, 2015-2020 (k units)

Chart 6: Global server shipment share by client type, 2015-2020

Chart 7: Global server shipments by client, 2015-2020 (k units)

Chart 9: Taiwan server shipments by maker, 2015-2020 (k units)

Chart 11: Taiwan maker-client shipment matrix, 2019 (k units)

Chart 12: Taiwan maker-client shipment matrix, 2018 (k units)

Chart 19: Inventec server shipments by client, 2015-2019 (k units)

Chart 22: Wistron server shipments by client 2015-2019 (k units)

Chart 25: Foxconn server shipments by client, 2015-2019 (k units)

Chart 28: Quanta server shipments by client, 2015-2019 (k units)

Chart 31: Mitac server shipments by client, 2015-2019 (k units)

Table 3: AI model training and inference applications in servers

Chart 33: Datacenter server shipment share by network speed, 2019-2024

Chart 34: Enterprise server shipment share by network speed, 2019-2024