Taiwan is an important hub of the global information and communication technology (ICT) industry. The development of the ICT supply chain is supported by Taiwan's complete semiconductor ecosystem.

Benefits to the industrial supply chain

Taiwan's IC design sector is one of the main customer sources for foundry services and IC testing/packaging, and it has indirectly boosted semiconductor material and equipment demand. On the other hand, it also enables the downstream ICT industry to continue to evolve and provide products that are more cost-effective, more efficient, more energy-saving, and more innovative.

The IC design sector plays a key role in linking the upstream, midstream, and downstream of the industry and allows them to prosper. Therefore, the development of Taiwan's IC design sector will affect Taiwan's overall industry competitiveness in the tech sector!

Contributions to Taiwan's job market

Taiwan Semiconductor Industry Association (TSIA)'s "2022 Taiwan semiconductor talent research report" showed that in 2021, Taiwan's IC design sector had around 52,000 employees, accounting for 16% of all employees in Taiwan's semiconductor industry. Since the chip design sector has high requirements for education and level of expertise, it's considered a relatively high-end human resource. Nearly 70% of those in the chip design sector have a master's degree or higher, with majors mostly in electrical engineering and computer science.

The same TSIA report pointed out that in 2021, there were 54,000 semiconductor R&D personnel. Among them, 69% were engaged with IC design. On top of that, 73% of IC design employees are R&D personnel, compared to 10% for IC manufacturing and 4% for IC testing/packaging. This shows that the personnel demand is mainly for high-end technical R&D talent.

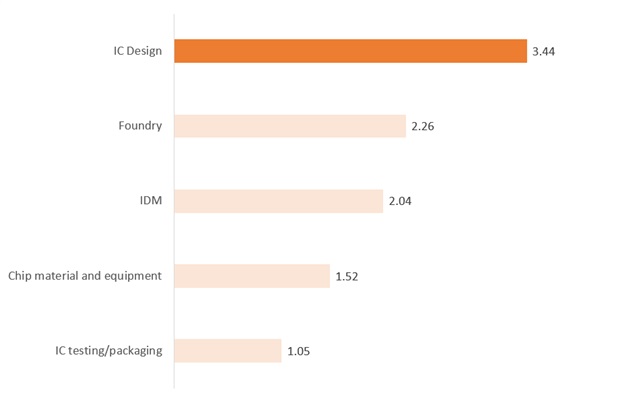

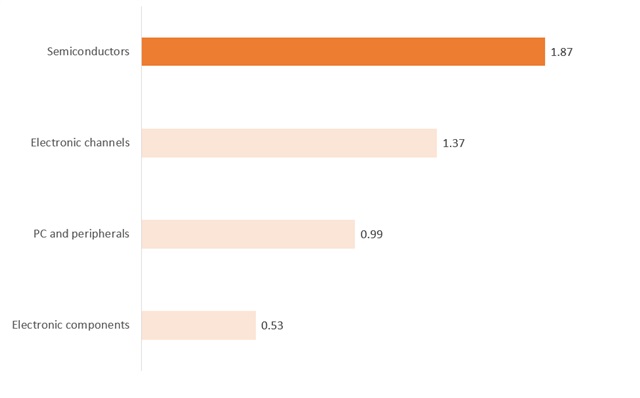

2021 average salary in Taiwan's electronics industry (in millions NT$)

Note: Calculated based on the 576 publically listed Taiwanese electronics companies. Credit: DIGITIMES Research, March 2023

2021 average salary in Taiwan's semiconductor sub-sectors (in millions NT$)

Note: Calculated based on the 576 publically listed Taiwanese electronics companies Credit: DIGITIMES Research, March 2023

Contributions to Taiwan's salary level

Observing the average annual salary of Taiwan's electronics industry in 2021, the semiconductor sector reached NT$1.87 million (around US$61,100), much higher than other sub-sectors like PC, peripherals, electronic channels, electronic components, and more. Further comparing each semiconductor sub-sector, the IC design sector's average salary reached NT$3.44 million (around US$112,000), the highest among all.

The main reason for this is that the IC design sector emphasizes R&D, thus it mainly procures high-level R&D talents. The benefits of R&D investments can also be reflected in profitability, which can result in better pay for the employees. This better pay can then attract more top talent to join the IC design industry, creating a positive loop.

According to a survey conducted by a leading Taiwanese recruitment agency in May 2022, in practice, the average monthly salary of IC design engineers with 3 years of working experience is more than NT$70,000. This figure is better than semiconductor process engineers (NT$58,000) and software engineers (NT$55,000), making IC design jobs a popular choice for job seekers.

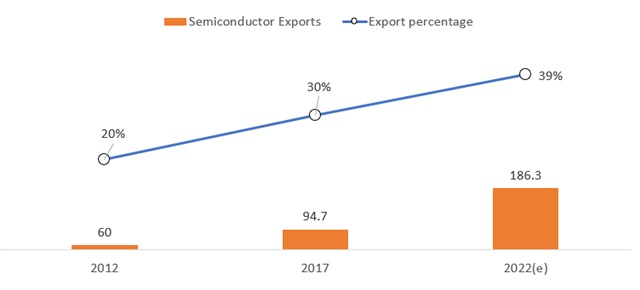

Contributions to Taiwan's export and economy

Exports play a crucial role in driving Taiwan's economic development. Among the many export goods, semiconductors have the utmost importance.

In 2022, Taiwan's semiconductor (both finished and semi-finished products) export value is expected to exceed US$180 billion, accounting for nearly 40% of the total export value. Compared to the 20% figure in 2012, this shows that the importance of semiconductors to Taiwanese exports has further increased. The implication behind all of this is its contributions to Taiwan's economic growth have also significantly increased.

From a trade surplus perspective, Taiwan's semiconductor trade surplus (i.e. net exports) has surpassed Taiwan's overall trade surplus since 2019, becoming a key momentum driver for Taiwan's economic growth. From the perspective of Taiwan's semiconductor value chain, the revenue share of Taiwan's IC design sector is estimated to reach 23% - higher than the share of IDMs (5%). Therefore, Taiwan's semiconductor product exports are mainly contributed by the IC design sector.

In other words, the contributions of the IC design sector to Taiwan's economic growth are increasing by the day.

If we are to calculate GDP from the production perspective, GDP is equal to the total value added from each industry (total production - intermediate inputs). Taiwan's 2021 GDP was NT$21.71 trillion (US$0.71 trillion). The added value of the semiconductor industry was NT$2.62 trillion, contributing 12% to the GDP. Among that, the added value of the IC design sector was NT$525.8 billion, contributing 2.4% to the GDP and only behind foundry services within the semiconductor industry.

If we look at the major sub-sectors under the four big manufacturing industries of information electronics, metal machinery, chemical engineering, and civil engineering, the IC design sector's 2021 domestic employee count of 52,000 was less than other sub-sectors. Yet its GDP contributions were higher than downstream tech industries like computers, electronic goods, and optical products. It was also higher than the industries of base metal, metal products, machinery equipment, chemical material, and chemical products. This demonstrates the IC design sector's high contributions to Taiwan's economic development.

IC products account for nearly 4% of Taiwan's total exports (in billions US$)

Note: Calculated based on HS8541 and HS8542 finished and semi-finished semiconductor products. Credit: DIGITIMES Research, March 2023

Editor's note: At the Taiwan IC Design Industrial Policy White Paper Presentation scheduled on March 28, Taiwan Semiconductor Industry Association (TSIA) will release its IC Design White Paper to guide Taiwan's semiconductor policy. As a co-organizer, DIGITIMES will publish a series of articles to summarize the document. The white paper will be available for download after the event.