Taiwan's ambitious offshore wind plans are facing a significant challenge as the island nation grapples with a dispute with the European Union over local content requirements. The contentious issue, centered on Rounds 3.1 and 3.2 of Taiwan's offshore wind auctions, has raised concerns about the potential retroactive application of these requirements. However, Dr. Chung-Hsien Chen from Taiwan's Ministry of Economic Affairs has provided reassurance, emphasizing that retroactive application is not being considered.

"Negotiations between the Taiwanese government and the EU are ongoing," Dr. Chen stated. "While a definitive agreement has not yet been reached, both parties have established a clear direction in their talks. We've decided to move towards a compromise, but we still need to discuss some detailed technical solutions."

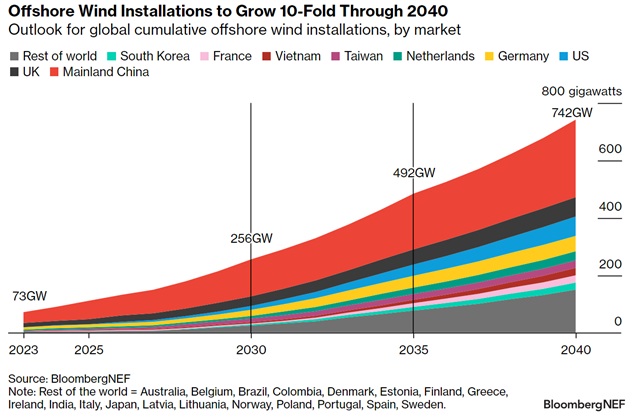

This dispute comes at a critical time for Taiwan's offshore wind industry, as the country positions itself as a key player in the global market. With projections indicating that global offshore wind capacity will reach 742 GW by 2040, Taiwan's ability to navigate these challenges could have far-reaching implications for its energy future and its role in the renewable energy sector.

Credit: Bloomberg

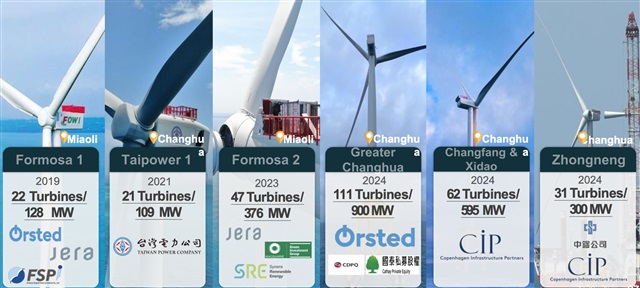

Taiwan has already made impressive strides, ranking 7th globally in offshore wind power installation capacity in 2023, according to the 2024 Global Wind Energy Council report. The government aims to install between 40 to 55 GW of offshore wind capacity by 2050, a dramatic increase from the current 3 GW. As of mid-September 2024, Taiwan had installed 370 turbines, demonstrating significant progress in a short time.

However, the rapid expansion has not been without its challenges. The most recent auctions, known as Rounds 3.1 and 3.2, have highlighted tensions between the government's desire for local content and the need for international expertise and investment.

Fully-commissioned offshore wind farm in Taiwan. Credit: Energy Administration

Industry concerns

Andreas Munk-Janson, Head of Operations for Ørsted APAC, expressed concerns about the high localization requirements in recent auctions. "What we have seen from auctions 3.1 and 3.2 are obviously high localization requirements. Of course, that firstly in 3.1 did make us choose not to participate," Munk-Janson stated.

The local content issue has drawn international attention, with the EU reportedly putting pressure on the Taiwanese government to reconsider its approach. Munk-Janson emphasized the need for a level playing field: "We need to ensure that it's an equal game. It's equal for everyone, that we don't treat certain kinds of industry developers with certain advantages."

The tension between local content requirements and international participation reflects a broader challenge facing Taiwan's offshore wind ambitions. While the government aims to develop a robust domestic supply chain, it also recognizes the need for foreign expertise and investment to achieve its ambitious targets.

The stakes are high, with Chen revealing that developers have proposed over 10 GW of projects for the current phase, of which only about 5.5 GW will be selected. This competitive environment, coupled with challenging market conditions, has raised concerns about project viability.

Exploring solutions

To address these challenges, the Taiwanese government is exploring several solutions. These include reviewing government fees for different types of projects, encouraging state-owned banks to participate in project financing, and developing mechanisms to allow smaller enterprises to participate in green energy purchases.

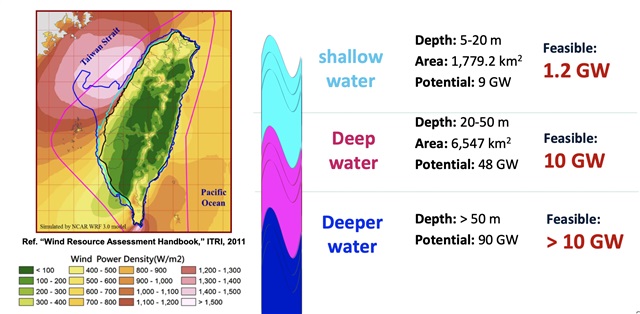

Taiwan's Offshore Wind Power Potential

Credit: Energy Administration

Despite these challenges, both government officials and industry representatives remain optimistic about Taiwan's offshore wind future. Chen highlighted the country's clear targets and transparent processes as strengths, while Munk-Janson emphasized the importance of creating a sustainable industry that benefits all stakeholders.

As Taiwan moves forward with its ambitious offshore wind plans, the resolution of the local content issue and the government's ability to balance domestic development with international expertise will be crucial. The outcome of these discussions will not only shape Taiwan's energy future but could also serve as a model for other emerging offshore wind markets in the region.

With 11 projects from Rounds 3.1 and 3.2 in the pipeline and more to come, the next few years will be critical in determining whether Taiwan can successfully navigate these challenges and establish itself as a major player in the global offshore wind industry.

Credit: Ørsted