During the Asia Economic Dialogue held in India, Ajit Manocha, the President of Semiconductor Equipment and Materials International (SEMI), expressed his belief that the semiconductor industry will continue to thrive for the next 50 years, a sentiment with which I wholeheartedly agree.

The significance of semiconductors cannot be overstated, as they are critical to shaping the future of the world. The semiconductor market is bolstered by its strong long-term outlook, and the IC design industry is particularly noteworthy for its application-driven and cross-industry linkage. Currently, only Taiwan, alongside the United States, holds a significant position in this industry.

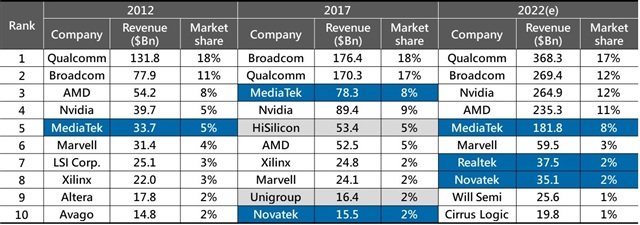

Source: DEGITIMES Research, January 2023

Although South Korea's population is 2.15 times that of Taiwan, Taiwan's IC design industry revenue surpasses South Korea's by 14 times. This disparity can be attributed to South Korea's electronics manufacturing industry being heavily concentrated in a few companies, which limits opportunities for local IC design firms to collaborate and succeed. Conversely, Taiwan has established strong semiconductor manufacturing clusters. In 2022 alone, 500 publicly listed electronic manufacturers such as Foxconn, Pegatron, Wistron, Quanta, and Compal generated a production value of $500 billion and stimulated a demand of nearly $400 billion in components. The demand generated by these local manufacturers acts as an incubator for the development of Taiwan's IC design industry.

The electronics manufacturing industry in Taiwan is massive, with Taiwanese companies contributing over 70% of the total revenue among the top 30 EMS manufacturers in the world. Taiwan's industry has inherent advantages in the cost of BOM (bill of materials) parts and materials for products like laptops and mobile phones, which typically account for close to 80% of the product cost. However, with the industry heavily concentrated on computers and mobile phones, the shift towards diverse applications such as electric vehicles brings new pressures to the industry.

The apprehensions of Taiwan's IC design industry are evident from the decline in its global market share. From 2012 to 2017, Taiwan's market share fell from 20% to 19%, and further dropped to 18% in 2022. DIGITIMES Research projects that without effective and targeted measures, the market share could decrease to 17% and could even be surpassed by China's 18% by 2026.

Out of the global semiconductor market worth $575.1 billion, 33% is dedicated to computer products like laptops and servers, in which Taiwan has excelled. Additionally, 35% of the market is attributed to the communication sector, mainly mobile phones. Taiwan occupies a distinctive and dominant position in contract manufacturing. Consequently, Taiwan's IC design industry enjoys a significant advantage in the production of laptops, servers, and mobile phones.

Despite its prosperity, Taiwan's IC design industry is facing new challenges with the rise of the Internet of Things and application-driven trends. The increasing demand in sectors like automotive, military, and industrial control applications are uncharted territory for Taiwan's IC design companies. As a result, the industry is facing significant hidden concerns behind its current success.