Global automotive display shipments are estimated to reach 225 million units in 2024, up 7.8% from a year ago, according to Jason Yang, DIGITIMES Research analyst specializing in the display industry. Yang notes that while a-Si will remain the mainstream technology for automotive displays for the next five years, the market share of other non-a-Si displays will all grow.

Yang notes that the shipment growths of overall automotive displays over the next five years will be limited despite displays' rising penetration in the automotive industry as well as the growing adoption of automotive panels, with volumes only expected to reach 280 million units by 2029, a compound annual growth rate (CAGR) of 4.5% during the period from 2024-2029.

In terms of applications, center consoles and dashboards are the top two adopters of automotive displays. Although pure center-console displays have almost reached full saturation, with ultra-large automotive and passenger seat panels that integrate center consoles and dashboards also being considered center console panels, the application currently only accounts for around 50% of overall automotive display shipments.

However, the percentage will start to slide after 2026 due to the rising penetration of head-up and rear-view mirror displays, the two applications with the highest growth potential, while the proportion of shipments for dashboards will be maintained at around 34%.

Head-up displays are expected to enjoy better-than-expected growth over the next few years due to Chinese automakers' keen adoption, while rear-view mirror displays are unlikely to experience obvious growth until 2026 or 2027, Yang said.

Because of LTPS TFT LCD technology's high opening rate, they are suitable for high-definition and embedded touch-control panels and can also be paired with miniLED backlight modules to enhance the panels' dynamic contrast ratio, which has boosted the technology's market share in the midrange to high-end automotive panel market in the recent years.

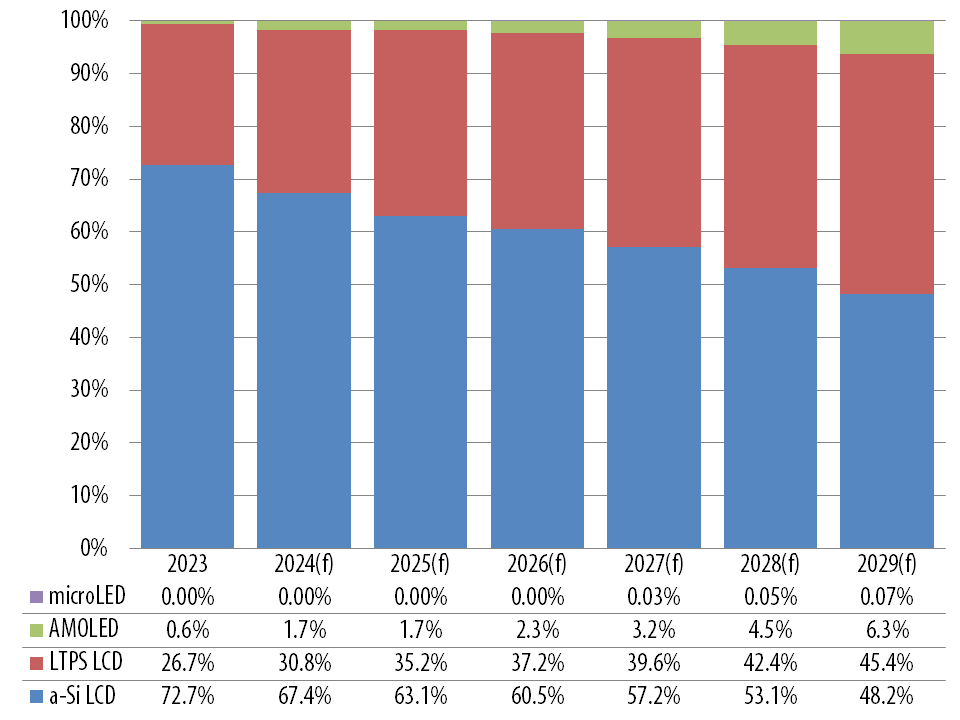

Yang expects LTPS TFT LCD to account for 45.4% of all automotive display shipments by 2029, up from 2024's 30.8% with a shipment CAGR of 12.9% over the six-year period.

Although AMOLED is known for its poor environmental endurance under extreme weather, its thin and light characteristics and high contrast ratio still helped the technology to earn favor from Korean panel makers, while Chinese and Japanese makers have also been investing keenly in related development.

AMOLED display shipments are expected to see its ratio in total automotive display volumes soar dramatically from 2024's 1.7% to 2029's 6.3% with a 6-year CAGR estimated at 35.1%, Yang stated.

As for microLED, which is viewed to have the most chance to become the mainstream display technology of the next generation, with Taiwan-based AUO pushing keenly for volume production of the related panels, its mass adoption in automotive displays is likely to happen before the end of 2026, Yang noted.

Automotive displays using a-Si is still the mainstream with its share expected to stay at above 65% of overall automotive display shipments in 2024. The share will stay above 50% until dropping to 48.2% in 2029, Yang added.

The Chinese version of the global automotive display market report is available. If you are interested in the English report, please contact us to inquire.

Global automotive display shipment share by technology, 2023-2029

Source: DIGITIMES Research, July 2024

About the Analyst

Jason Yang, MSc. in physics at the National Central University, Taiwan, has previously worked as an R&D engineer at Quanta Display. His research areas include small-sized display technologies, automotive display technologies, and emerging display technologies (e.g. AMOLED).