While the global EV market shifts gears into a phase of slower, regionally fragmented growth (15.2%) as subsidies fade, the edge AI chip sector is aggressively evolving. DIGITIMES observes a clear bifurcation in semiconductor strategies: startups are now splitting between cost-effective mature nodes and high-risk, high-performance bets on sub-5nm processes to meet surging computing demands.

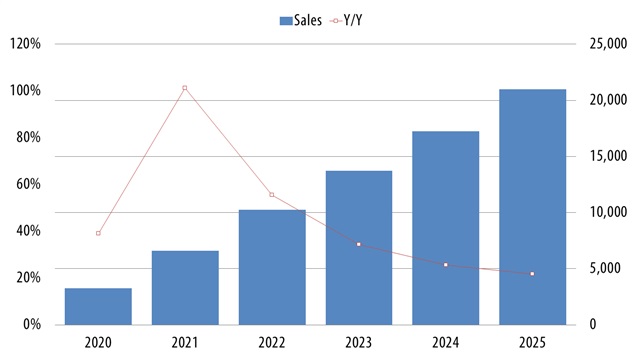

Global EV sales, 2025 review & 2026 forecast

According to DIGITIMES' observations, the global automotive market in 2025 saw only modest growth amid tariff pressures and a high-interest-rate environment. Nevertheless, electric vehicles (EVs) continued to maintain strong momentum, with full-year sales reaching 20.985 million units, outperforming expectations, driven primarily by rising demand in Chinese and European markets.

Looking ahead to 2026, global automotive market demand is expected to grow marginally, while the EV sector will enter a phase of slower expansion, with an annual growth rate of 15.2%. As subsidies are phased out and policy frameworks are adjusted across major global automotive markets, growth momentum in the three leading markets—China, Europe, and the US—is expected to moderate, giving rise to a new landscape characterized by "slowing growth alongside increasing regional divergence."

In 2025, the global automotive market exhibited a pattern of slow growth, with annual sales reaching 91.4 million units, representing a year-on-year increase of only 1.7%. This was primarily due to the impact of tariff wars and elevated interest rates, which dampened consumer willingness to purchase vehicles.

Global EV sales, 2020-2025 (k units)

Source: Automobile and auto manufacturer associations worldwide and DIGITIMES, January 2026

Strategies and deployment of edge AI chip startups

AI computing architectures are shifting from centralized cloud processing toward the edge. Consequently, hardware requirements for edge AI chips are rising steadily, demanding a careful balance between computing performance and power efficiency, according to DIGITIMES.

Historically, most edge AI chips were manufactured on mature process nodes below 22nm to control costs. Recently, however, startups such as DeepX have begun adopting advanced process technologies below 5nm, seeking to meet flagship product requirements through increased transistor density.

As a result, a clear bifurcation is emerging in foundry strategies for edge AI processors: more conservative products that prioritize cost control and supply stability continue to rely on TSMC's mature nodes, while more aggressive, flagship-oriented on-premises datacenter products are willing to assume higher risk by adopting Samsung Electronics' advanced processes.

Article edited by Joseph Tsai