Despite political and national security concerns about US domestic semiconductor production, American companies continue to account for more than half of the global chip industry's total spending on research and development, according to the latest annual analysis of R&D expenditures by TechInsights.

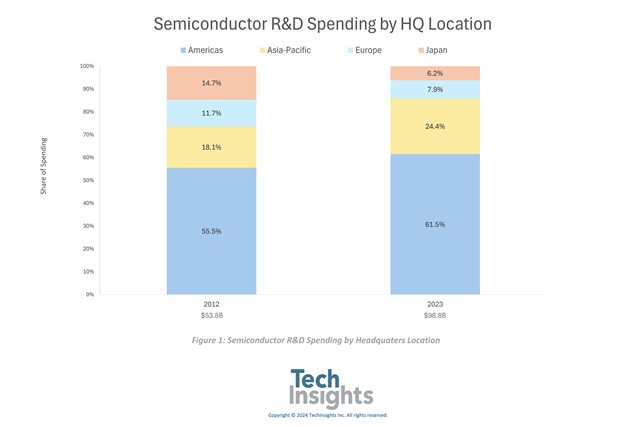

About 62% of worldwide semiconductor industry R&D spending in 2023 was by companies headquartered in the Americas region—essentially all of them in the US and a large chunk of that came from Intel (16%, or $16.0 billion last year), according to TechInsights' analysis of research and development trends published in its June Update of the 2024 McClean Report (Figure 1). The top 10 semiconductor R&D spenders in 2023 included six US companies, two Taiwan companies, one South Korean and one European company.

Semiconductor R&D expenditures by Asia-Pacific companies—including wafer foundries, fabless chip suppliers, and integrated device manufacturers (IDMs)—accounted for about 24% of the worldwide total in 2023, followed by suppliers based in Europe at about 8%, and Japan at 6% of industry spending. Since 2012, the global share of semiconductor R&D expenditures held by chip suppliers based in the Americas has grown from nearly 56% and the percentage held by Asia-Pacific companies (including China) has climbed from 18%.

Semiconductor R&D Spending by Headquarters Location. Credit: TechInsights

Semiconductor companies based in Taiwan—including wafer foundries, like Taiwan Semiconductor Manufacturing Co, (TSMC)—accounted for 14.4% of the industry's total R&D expenditures in 2023 (about $14.2 billion). South Korean suppliers primarily Samsung and SK Hynix—represented 8.1% ($8.0 billion) of global semiconductor R&D spending and Chinese companies accounted for about 2% of semiconductor R&D expenditures last year. The rest of the Asia-Pacific region accounted for less than 1.0% of the global total, according to the updated report.

Worldwide, semiconductor companies collectively spent 17.7% of their combined sales on R&D in 2023 ($98.8 billion) versus 16.9% ($53.8 billion) in 2012, according to TechInsights' June Update of The McClean Report. R&D spending covered by TechInsights includes expenditures by integrated device manufacturers (IDMs), fabless chip suppliers, and pure-play foundries, but does not include other companies and organizations involved in semiconductor-related technologies, such as production equipment and materials suppliers, packaging and test service providers, universities, government-funded labs, and industry cooperatives.

R&D expenditures as a percent of semiconductor sales for companies headquartered in the Americas region averaged 21.5% in 2023 and was 11.7% for semiconductor suppliers in the Asia-Pacific region. European companies spent about 13.6% of their combined chip revenues on research and development last year and Japanese semiconductor companies had an R&D/sales ratio of 12.9% in 2023.

South Korean companies (heavily influenced by memory giants Samsung and SK Hynix) had an R&D/sales ratio of 10.2% last year. Taiwanese and Chinese companies averaged about 7.0% and 11.0%, respectively, in 2023.

About The McClean Report

The McClean Report—A Complete Analysis and Forecast of the Semiconductor Industry, is available by subscription. The McClean Report service includes a January Semiconductor Industry Flash Report, which provides clients with an initial overview and forecast of the semiconductor industry through 2028. Monthly Updates continue throughout the year. Find out more about the McClean Report.

About TechInsights

TechInsights is the information platform for the semiconductor industry.

Regarded as the most trusted source of actionable, in-depth intelligence related to semiconductor innovation and surrounding markets, TechInsights' content informs decision-makers and professionals whose success depends on accurate knowledge of the semiconductor industry—past, present, or future.

Over 650 companies and 85,000 users access the TechInsights Platform, the world's largest vertically integrated collection of unmatched reverse engineering, teardown, and market analysis in the semiconductor industry. This collection includes detailed circuit analysis, imagery, semiconductor process flows, device teardowns, illustrations, costing and pricing information, forecasts, market analysis, and expert commentary.

TechInsights' customers include the most successful technology companies who rely on TechInsights' analysis to make informed business, design, and product decisions faster and with greater confidence. Find out more on the TechInsights platform.