Silicon photonics is emerging as the strongest growth engine within Taiwan's semiconductor manufacturing sector.

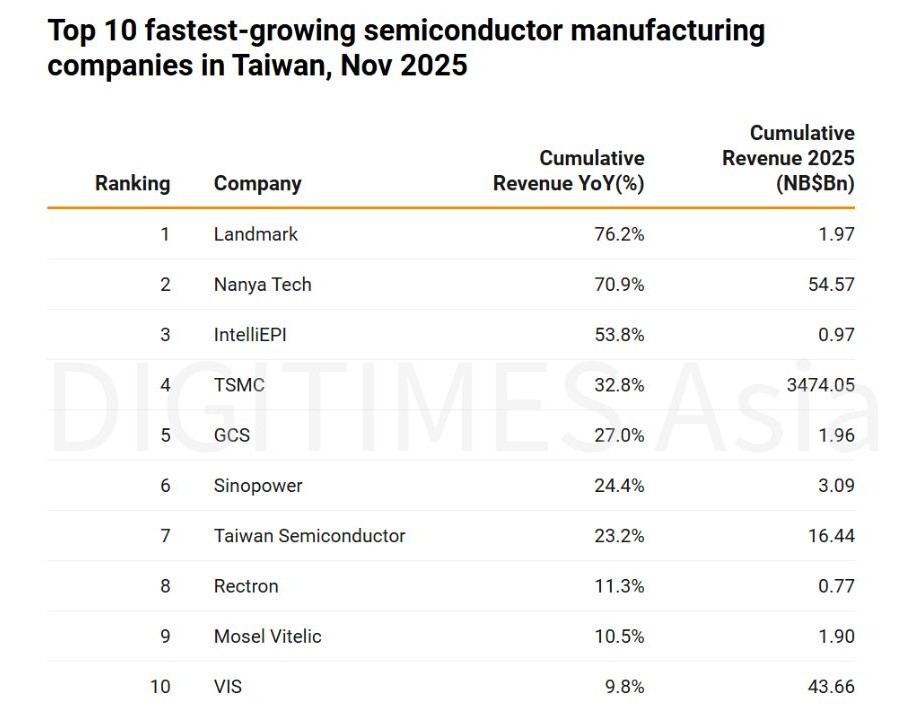

According to cumulative revenue data through November 2025, three of the top five fastest-growing semiconductor manufacturing companies in Taiwan operate in the silicon-photonics or compound-semiconductor supply chain: LandMark Optoelectronics, IntelliEPI, and GCS.

The rankings highlight an important shift: within the manufacturing segment alone, the fastest acceleration is occurring upstream in photonics and III–V epitaxy rather than in traditional silicon processing.

LandMark leads Taiwan's semiconductor manufacturers with 76.2% growth

LandMark Optoelectronics, a producer of InP and GaAs epi-wafers for optical communication, ranked first among semiconductor manufacturers with 76.2% year-over-year cumulative revenue growth, reaching NT$1.97 billion (US$60.3 million).

Its momentum reflects surging demand for photonic components used in 800G/1.6T optical modules and hyperscale data-center networks. LandMark expects silicon photonics to become the dominant architecture for next-generation transceivers.

Credit: DIGITIMES

Nanya Technology ranks second on DRAM recovery

Nanya Technology took the second spot with 70.9% cumulative revenue growth, reaching NT$54.57 billion (US$1.67 billion). The company has benefited from a strong rebound in DDR4 demand, with management projecting continued improvement in margins and profitability heading into 2026.

IntelliEPI climbs to third with silicon-photonics CPO strategy

IntelliEPI ranked third, posting 53.8% cumulative revenue growth and NT$0.97 billion (US$29.7 million) in revenue. The compound-semiconductor epitaxy specialist recently approved a share-swap partnership with optical-component maker EZconn aimed at advancing silicon-photonics co-packaged optics (CPO).

The collaboration positions IntelliEPI to extend from upstream epitaxy into downstream optical-component and module manufacturing.

TSMC ranks fourth despite its large base

TSMC placed fourth, with 32.8% cumulative growth and NT$3.474 trillion (US$106.3 billion) in revenue. While its growth rate is lower than smaller manufacturers, TSMC's scale remains unmatched within Taiwan's semiconductor manufacturing sector.

GCS rounds out the top five

GCS ranked fifth, reporting 27% cumulative revenue growth to NT$1.96 billion. The company has benefited from rising demand for optoelectronic devices, including laser products aligned with silicon-photonics transmission architectures.

Photonics firms rise to the top of manufacturing growth

DIGITIMES Research notes that GaAs and InP materials—used for optical lasers, photodetectors, and high-speed communication modules—are gaining strategic importance due to AI workloads and hyperscale data-center bandwidth needs.

As silicon-photonics platforms gain traction globally, demand for InP-based lasers and epitaxial materials continues to accelerate.

This industry shift explains why three of the top five fastest-growing semiconductor manufacturing companies in Taiwan in 2025 are rooted in the photonics and compound-semiconductor value chain.

The growth data shows a clear pattern: within semiconductor manufacturing—not the broader chip industry—photonics suppliers are now driving the fastest expansion as the world races to upgrade optical infrastructure for AI.

Article edited by Jerry Chen