When the world is de-globalizing, it is the best time for Taiwan to re-connect to the global market. When a Taiwan-based IC distributor is moving toward the European and American markets via acquisition, how can Taiwanese fabless companies not gauge the pulse of this important trend?

Is Taiwanese IC distributor WT Microelectronics' acquisition of Canadian electronics components distributor Future Electronics just a simple cross-border merger and acquition (M&A) transaction? Of course not! The companies in the semiconductor industry have become a "protected species" that all countries are reluctant to sell to others. However, the component distribution channels did not get enough attention from the community, and the trend of de-globalization/regionalization will inevitably drive the M&A activities in this industry in the years to come.

In the past, Taiwan-based electronic component distributors were granted agency only in Asia or the Greater China region. Based on the global surface mount technology (SMT) import value over the past few years, we can deduce the future demand for semiconductor components. We can also understand that India, Vietnam, and Thailand will become more and more important as SMT equipment-importing countries. Mexico is already the world's third-largest SMT equipment-importing nation after China and the United States.

In view of significant growth potential in the future, WT Microelectronics took the initiative to acquire a Canadian counterpart to get the ticket to the market in the Americas.

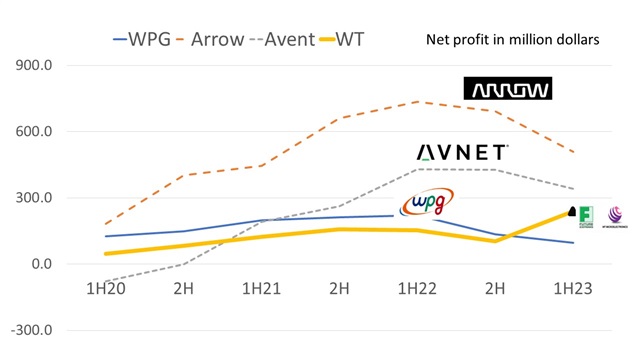

Generally speaking, Taiwan-based distributors' strengths focus on PC and smartphone-related components, while North American distributors such as Avnet, Arrow, and Future are more competitive in modulization and system integration, catering to the needs of high-end market customers. Therefore, the operational profit rate of these companies is often 3 times that of Taiwan-based distributors. Future Electronics's post-tax earnings are double that of WT Microelectronics, although the latter is the fourth largest distributor in the world.

The merger is complementary and is expected to create synergy, as North American companies have a limited presence in Asia, which is the major source of sales to Taiwan-based distributors. Since India, Vietnam, and Thailand are becoming new manufacturing hubs of the world due to supply chain migration, the parts and component distributors have already spotted new opportunities.

The Taiwan-based distributors have divided customers in Southeast Asia and South Asia into three groups: "TBM", "CBM", and "MBM", and currently Taiwan-based manufacturers, including the ODMs such as Quanta, Wistron, Pegatron, Inventec, Compal and Foxconn, are the biggest group in this TBM category (C and M stand for "China" and "Multinational"). It is critical for distributors to follow their customers to wherever they set up factories. However, the best way for Taiwan-based distributors to do business in European and American markets is definitely leveraging local knowledge and experiences, instead of trying to do it by themselves.

What is noteworthy is that, since China's IC design companies are moving towards developing mature-node ICs due to US government's export sanction on advanced semiconductor technologies, they are squeezing the room of Taiwan's IC design firms which specialize in mature-node ICs in that market.

IC design companies should wake up to the imminent trend of regionalization, as vicious competition from their Chinese competitors will take away their business sooner or later. The IC distributor merger with North American firms is a harbinger of the new regionalization trend. If IC design houses fail to react and prepare for internationalization now, it may be too late.

Credit: DIGITIMES