ASML Holding's management says demand tied to artificial intelligence is proving more durable than previously expected, with customers accelerating capacity planning that is likely to support orders for the Dutch company's most advanced lithography systems into and beyond 2026.

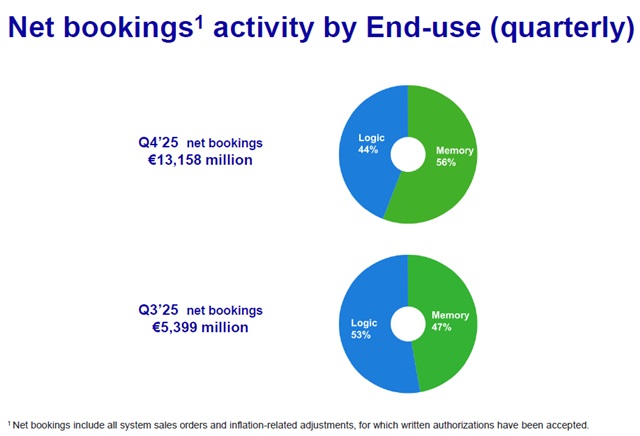

In a video interview accompanying ASML's fourth-quarter and full-year 2025 results, CEO Christophe Fouquet said customers have grown more confident in the sustainability of AI-related demand in recent months, prompting them to step up medium-term investment plans. That shift, he said, is translating into stronger demand for ASML's advanced tools across both logic and memory manufacturing.

"We see a strong belief that the AI demand is real," Fouquet said in the interview, adding that customers are preparing for "a major addition of capacity" that will begin in 2026 and extend beyond that.

EUV demand rises across logic and memory

Fouquet said the improved outlook is visible across multiple segments of the semiconductor industry. In logic, customers are becoming more comfortable with long-term AI demand and are accelerating capacity plans as they move from 4nm to 3nm production and prepare for future 2nm ramps for mobile and high-performance computing applications.

In memory, he said demand is strong not only for high-bandwidth memory but also for DDR products, creating tight supply conditions that are expected to persist into 2026 and beyond. That environment is driving customers to ramp more advanced DRAM nodes, which require a higher number of extreme ultraviolet lithography layers.

CFO Roger Dassen said ASML expects EUV revenue to increase significantly compared with 2025 as a result of those trends. While the company expects its non-EUV systems business to be broadly flat year over year, he said demand within that segment remains solid for advanced logic and memory, as well as for metrology and inspection tools tied to tighter process control.

Dassen also said ASML expects continued growth in its installed base business, supported by the expanding fleet of EUV systems and customer interest in upgrades as a faster way to add output capacity.

Shares hit record high on investor optimism

Investors have responded positively to ASML's outlook. The Financial Times reported that ASML shares rose 7% to a record high in Amsterdam following the company's forecast for strong sales growth, lifting year-to-date gains to more than 20% and pushing its market value to nearly EUR500 billion (US$599.02 billion).

The rally spilled over into the broader semiconductor sector, with shares of STMicroelectronics and Infineon rising more than 6%, while futures on the Nasdaq 100 gained 0.8%.

Fouquet said that customers have "a strong belief that the AI demand is real" and are beginning to prepare for that with significant capacity additions. He said demand for ASML's latest technology is being driven by equipment used to produce advanced logic chips, such as Nvidia's graphics processors manufactured by TSMC, as well as memory chips made by companies including Micron, SK Hynix, and Samsung.

Inside the EUV machines powering AI chips

ASML's central role in advanced chip manufacturing rests on its dominance in extreme ultraviolet lithography. The machines, which cost about US$250 million each, are essential for producing the most advanced semiconductors and are used by manufacturers supplying AI chips.

Reuters reported that the EUV systems, roughly the size of a school bus and weighing about 150 tons, use a complex combination of lasers, mirrors, and magnetic levitation to etch microscopic circuitry onto silicon wafers with extreme precision. The technology operates at a wavelength of 13nm, far smaller than the width of a human hair, enabling the dense chip designs required for modern AI workloads.

To generate EUV light, droplets of tin are struck tens of thousands of times per second by powerful lasers, with mirrors manufactured by Zeiss directing the light through the system. The machines are assembled in the Netherlands and shipped in dozens of containers to chipmaking facilities operated by companies including TSMC, Samsung, SK Hynix, Intel, Micron, and Japan's Rapidus.

Outlook extends into 2026 and beyond

Looking ahead, Fouquet said the trends ASML highlighted at its November 2024 capital markets day are being reinforced by current customer behavior. AI applications, he said, are driving demand for more advanced logic and DRAM technology, increasing lithography intensity and supporting broader adoption of EUV.

Those dynamics underpin ASML's longer-term expectations. Fouquet reiterated that the company continues to target revenue of between EUR44 billion and EUR60 billion by 2030, with gross margins of 56% to 60%, as AI-related demand drives adoption of its most advanced products across the semiconductor industry.

Credit: ASML

Article edited by Jerry Chen